Page 377 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 377

Answers to questions

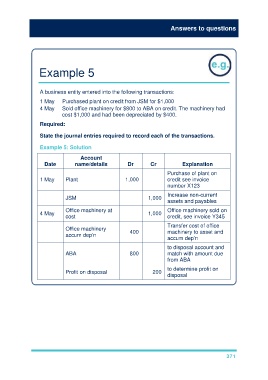

Example 5

A business entity entered into the following transactions:

1 May Purchased plant on credit from JSM for $1,000

4 May Sold office machinery for $800 to ABA on credit. The machinery had

cost $1,000 and had been depreciated by $400.

Required:

State the journal entries required to record each of the transactions.

Example 5: Solution

Account

Date name/details Dr Cr Explanation

Purchase of plant on

1 May Plant 1,000 credit see invoice

number X123

Increase non-current

JSM 1,000

assets and payables

Office machinery at Office machinery sold on

4 May 1,000

cost credit, see invoice Y345

Transfer cost of office

Office machinery

400 machinery to asset and

accum dep’n

accum dep’n

to disposal account and

ABA 800 match with amount due

from ABA

to determine profit on

Profit on disposal 200

disposal

371