Page 429 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 429

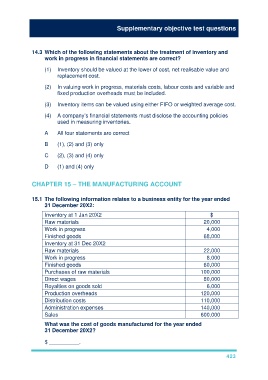

Supplementary objective test questions

14.3 Which of the following statements about the treatment of inventory and

work in progress in financial statements are correct?

(1) Inventory should be valued at the lower of cost, net realisable value and

replacement cost.

(2) In valuing work in progress, materials costs, labour costs and variable and

fixed production overheads must be included.

(3) Inventory items can be valued using either FIFO or weighted average cost.

(4) A company’s financial statements must disclose the accounting policies

used in measuring inventories.

A All four statements are correct

B (1), (2) and (3) only

C (2), (3) and (4) only

D (1) and (4) only

CHAPTER 15 – THE MANUFACTURING ACCOUNT

15.1 The following information relates to a business entity for the year ended

31 December 20X2:

Inventory at 1 Jan 20X2 $

Raw materials 20,000

Work in progress 4,000

Finished goods 68,000

Inventory at 31 Dec 20X2

Raw materials 22,000

Work in progress 8,000

Finished goods 60,000

Purchases of raw materials 100,000

Direct wages 80,000

Royalties on goods sold 6,000

Production overheads 120,000

Distribution costs 110,000

Administration expenses 140,000

Sales 600,000

What was the cost of goods manufactured for the year ended

31 December 20X2?

$ __________.

423