Page 427 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 427

Supplementary objective test questions

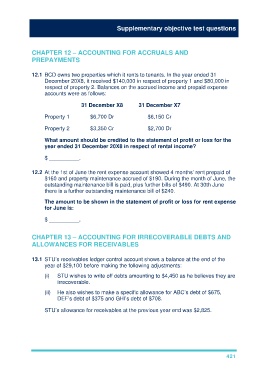

CHAPTER 12 – ACCOUNTING FOR ACCRUALS AND

PREPAYMENTS

12.1 BCD owns two properties which it rents to tenants. In the year ended 31

December 20X8, it received $140,000 in respect of property 1 and $80,000 in

respect of property 2. Balances on the accrued income and prepaid expense

accounts were as follows:

31 December X8 31 December X7

Property 1 $6,700 Dr $6,150 Cr

Property 2 $3,350 Cr $2,700 Dr

What amount should be credited to the statement of profit or loss for the

year ended 31 December 20X8 in respect of rental income?

$ __________.

12.2 At the 1st of June the rent expense account showed 4 months’ rent prepaid of

$160 and property maintenance accrued of $190. During the month of June, the

outstanding maintenance bill is paid, plus further bills of $490. At 30th June

there is a further outstanding maintenance bill of $240.

The amount to be shown in the statement of profit or loss for rent expense

for June is:

$ __________.

CHAPTER 13 – ACCOUNTING FOR IRRECOVERABLE DEBTS AND

ALLOWANCES FOR RECEIVABLES

13.1 STU’s receivables ledger control account shows a balance at the end of the

year of $29,100 before making the following adjustments:

(i) STU wishes to write off debts amounting to $4,450 as he believes they are

irrecoverable.

(ii) He also wishes to make a specific allowance for ABC’s debt of $675,

DEF’s debt of $375 and GHI’s debt of $708.

STU’s allowance for receivables at the previous year end was $2,825.

421