Page 425 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 425

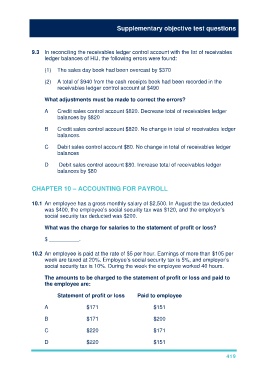

Supplementary objective test questions

9.3 In reconciling the receivables ledger control account with the list of receivables

ledger balances of HIJ, the following errors were found:

(1) The sales day book had been overcast by $370

(2) A total of $940 from the cash receipts book had been recorded in the

receivables ledger control account at $490

What adjustments must be made to correct the errors?

A Credit sales control account $820. Decrease total of receivables ledger

balances by $820

B Credit sales control account $820. No change in total of receivables ledger

balances.

C Debit sales control account $80. No change in total of receivables ledger

balances

D Debit sales control account $80. Increase total of receivables ledger

balances by $80

CHAPTER 10 – ACCOUNTING FOR PAYROLL

10.1 An employee has a gross monthly salary of $2,500. In August the tax deducted

was $400, the employee’s social security tax was $120, and the employer’s

social security tax deducted was $200.

What was the charge for salaries to the statement of profit or loss?

$ __________.

10.2 An employee is paid at the rate of $5 per hour. Earnings of more than $105 per

week are taxed at 20%. Employee’s social security tax is 5%, and employer’s

social security tax is 10%. During the week the employee worked 40 hours.

The amounts to be charged to the statement of profit or loss and paid to

the employee are:

Statement of profit or loss Paid to employee

A $171 $151

B $171 $200

C $220 $171

D $220 $151

419