Page 423 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 423

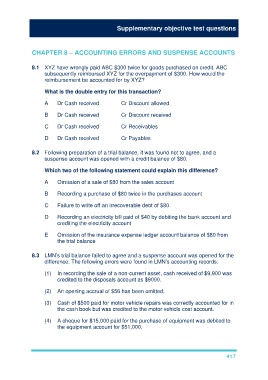

Supplementary objective test questions

CHAPTER 8 – ACCOUNTING ERRORS AND SUSPENSE ACCOUNTS

8.1 XYZ have wrongly paid ABC $300 twice for goods purchased on credit. ABC

subsequently reimbursed XYZ for the overpayment of $300. How would the

reimbursement be accounted for by XYZ?

What is the double entry for this transaction?

A Dr Cash received Cr Discount allowed

B Dr Cash received Cr Discount received

C Dr Cash received Cr Receivables

D Dr Cash received Cr Payables

8.2 Following preparation of a trial balance, it was found not to agree, and a

suspense account was opened with a credit balance of $80.

Which two of the following statement could explain this difference?

A Omission of a sale of $80 from the sales account

B Recording a purchase of $80 twice in the purchases account

C Failure to write off an irrecoverable debt of $80

D Recording an electricity bill paid of $40 by debiting the bank account and

crediting the electricity account

E Omission of the insurance expense ledger account balance of $80 from

the trial balance

8.3 LMN’s trial balance failed to agree and a suspense account was opened for the

difference. The following errors were found in LMN’s accounting records:

(1) In recording the sale of a non-current asset, cash received of $9,900 was

credited to the disposals account as $9000.

(2) An opening accrual of $56 has been omitted.

(3) Cash of $500 paid for motor vehicle repairs was correctly accounted for in

the cash book but was credited to the motor vehicle cost account.

(4) A cheque for $15,000 paid for the purchase of equipment was debited to

the equipment account for $51,000.

417