Page 419 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 419

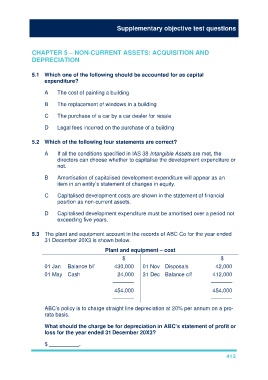

Supplementary objective test questions

CHAPTER 5 – NON-CURRENT ASSETS: ACQUISITION AND

DEPRECIATION

5.1 Which one of the following should be accounted for as capital

expenditure?

A The cost of painting a building

B The replacement of windows in a building

C The purchase of a car by a car dealer for resale

D Legal fees incurred on the purchase of a building

5.2 Which of the following four statements are correct?

A If all the conditions specified in IAS 38 Intangible Assets are met, the

directors can choose whether to capitalise the development expenditure or

not.

B Amortisation of capitalised development expenditure will appear as an

item in an entity’s statement of changes in equity.

C Capitalised development costs are shown in the statement of financial

position as non-current assets.

D Capitalised development expenditure must be amortised over a period not

exceeding five years.

5.3 The plant and equipment account in the records of ABC Co for the year ended

31 December 20X3 is shown below.

Plant and equipment – cost

$ $

01 Jan Balance b/f 430,000 01 Nov Disposals 42,000

01 May Cash 24,000 31 Dec Balance c/f 412,000

––––––– –––––––

454,000 454,000

––––––– –––––––

ABC’s policy is to charge straight line depreciation at 20% per annum on a pro-

rata basis.

What should the charge be for depreciation in ABC’s statement of profit or

loss for the year ended 31 December 20X3?

$ __________.

413