Page 421 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 421

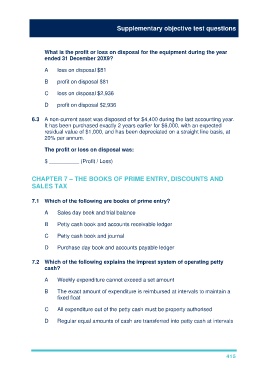

Supplementary objective test questions

What is the profit or loss on disposal for the equipment during the year

ended 31 December 20X9?

A loss on disposal $81

B profit on disposal $81

C loss on disposal $2,936

D profit on disposal $2,936

6.3 A non-current asset was disposed of for $4,400 during the last accounting year.

It has been purchased exactly 2 years earlier for $6,000, with an expected

residual value of $1,000, and has been depreciated on a straight line basis, at

20% per annum.

The profit or loss on disposal was:

$ __________ (Profit / Loss)

CHAPTER 7 – THE BOOKS OF PRIME ENTRY, DISCOUNTS AND

SALES TAX

7.1 Which of the following are books of prime entry?

A Sales day book and trial balance

B Petty cash book and accounts receivable ledger

C Petty cash book and journal

D Purchase day book and accounts payable ledger

7.2 Which of the following explains the imprest system of operating petty

cash?

A Weekly expenditure cannot exceed a set amount

B The exact amount of expenditure is reimbursed at intervals to maintain a

fixed float

C All expenditure out of the petty cash must be property authorised

D Regular equal amounts of cash are transferred into petty cash at intervals

415