Page 436 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 436

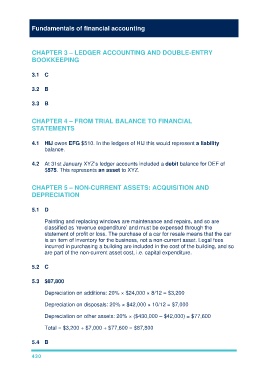

Fundamentals of financial accounting

CHAPTER 3 – LEDGER ACCOUNTING AND DOUBLE-ENTRY

BOOKKEEPING

3.1 C

3.2 B

3.3 B

CHAPTER 4 – FROM TRIAL BALANCE TO FINANCIAL

STATEMENTS

4.1 HIJ owes EFG $510. In the ledgers of HIJ this would represent a liability

balance.

4.2 At 31st January XYZ’s ledger accounts included a debit balance for DEF of

$575. This represents an asset to XYZ.

CHAPTER 5 – NON-CURRENT ASSETS: ACQUISITION AND

DEPRECIATION

5.1 D

Painting and replacing windows are maintenance and repairs, and so are

classified as ‘revenue expenditure’ and must be expensed through the

statement of profit or loss. The purchase of a car for resale means that the car

is an item of inventory for the business, not a non-current asset. Legal fees

incurred in purchasing a building are included in the cost of the building, and so

are part of the non-current asset cost, i.e. capital expenditure.

5.2 C

5.3 $87,800

Depreciation on additions: 20% × $24,000 × 8/12 = $3,200

Depreciation on disposals: 20% × $42,000 × 10/12 = $7,000

Depreciation on other assets: 20% × ($430,000 – $42,000) = $77,600

Total = $3,200 + $7,000 + $77,600 = $87,800

5.4 B

430