Page 437 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 437

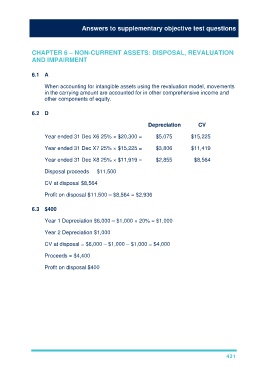

Answers to supplementary objective test questions

CHAPTER 6 – NON-CURRENT ASSETS: DISPOSAL, REVALUATION

AND IMPAIRMENT

6.1 A

When accounting for intangible assets using the revaluation model, movements

in the carrying amount are accounted for in other comprehensive income and

other components of equity.

6.2 D

Depreciation CV

Year ended 31 Dec X6 25% × $20,300 = $5,075 $15,225

Year ended 31 Dec X7 25% × $15,225 = $3,806 $11,419

Year ended 31 Dec X8 25% × $11,919 = $2,855 $8,564

Disposal proceeds $11,500

CV at disposal $8,564

Profit on disposal $11,500 – $8,564 = $2,936

6.3 $400

Year 1 Depreciation $6,000 – $1,000 × 20% = $1,000

Year 2 Depreciation $1,000

CV at disposal = $6,000 – $1,000 – $1,000 = $4,000

Proceeds = $4,400

Profit on disposal $400

431