Page 440 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 440

Fundamentals of financial accounting

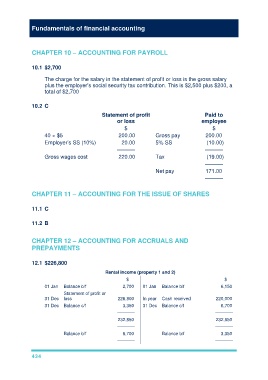

CHAPTER 10 – ACCOUNTING FOR PAYROLL

10.1 $2,700

The charge for the salary in the statement of profit or loss is the gross salary

plus the employer’s social security tax contribution. This is $2,500 plus $200, a

total of $2,700

10.2 C

Statement of profit Paid to

or loss employee

$ $

40 × $5 200.00 Gross pay 200.00

Employer’s SS (10%) 20.00 5% SS (10.00)

–––––– ––––––

Gross wages cost 220.00 Tax (19.00)

––––––

Net pay 171.00

––––––

CHAPTER 11 – ACCOUNTING FOR THE ISSUE OF SHARES

11.1 C

11.2 B

CHAPTER 12 – ACCOUNTING FOR ACCRUALS AND

PREPAYMENTS

12.1 $226,800

Rental income (property 1 and 2)

$ $

01 Jan Balance b/f 2,700 01 Jan Balance b/f 6,150

Statement of profit or

31 Dec loss 226,800 In year Cash received 220,000

31 Dec Balance c/f 3,350 31 Dec Balance c/f 6,700

––––––– –––––––

232,850 232,850

––––––– –––––––

Balance b/f 6,700 Balance b/f 3,350

––––––– –––––––

434