Page 443 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 443

Answers to supplementary objective test questions

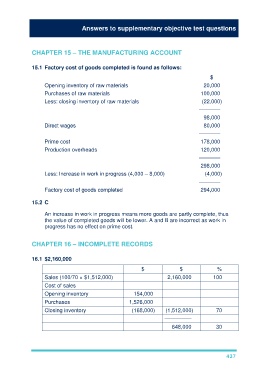

CHAPTER 15 – THE MANUFACTURING ACCOUNT

15.1 Factory cost of goods completed is found as follows:

$

Opening inventory of raw materials 20,000

Purchases of raw materials 100,000

Less: closing inventory of raw materials (22,000)

–––––––

98,000

Direct wages 80,000

–––––––

Prime cost 178,000

Production overheads 120,000

–––––––

298,000

Less: Increase in work in progress (4,000 – 8,000) (4,000)

–––––––

Factory cost of goods completed 294,000

15.2 C

An increase in work in progress means more goods are partly complete, thus

the value of completed goods will be lower. A and B are incorrect as work in

progress has no effect on prime cost.

CHAPTER 16 – INCOMPLETE RECORDS

16.1 $2,160,000

$ $ %

Sales (100/70 × $1,512,000) 2,160,000 100

Cost of sales

Opening inventory 154,000

Purchases 1,526,000

Closing inventory (168,000) (1,512,000) 70

–––––––––

648,000 30

437