Page 2 - P6 Slide Taxation - Lecture Day 6 - Retirement Benefits Lump Sums

P. 2

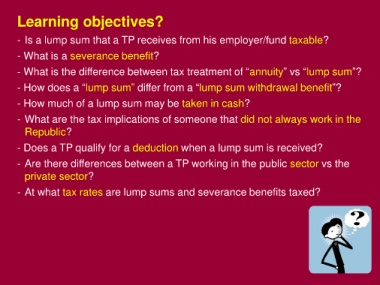

Learning objectives?

- Is a lump sum that a TP receives from his employer/fund taxable?

- What is a severance benefit?

- What is the difference between tax treatment of “annuity” vs “lump sum”?

- How does a “lump sum” differ from a “lump sum withdrawal benefit”?

- How much of a lump sum may be taken in cash?

- What are the tax implications of someone that did not always work in the

Republic?

- Does a TP qualify for a deduction when a lump sum is received?

- Are there differences between a TP working in the public sector vs the

private sector?

- At what tax rates are lump sums and severance benefits taxed?