Page 6 - P6 Slide Taxation - Lecture Day 6 - Retirement Benefits Lump Sums

P. 6

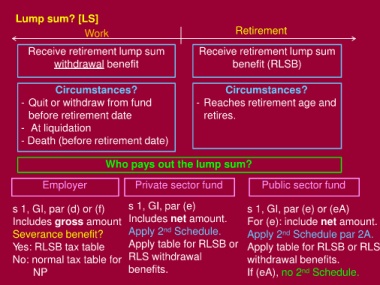

Lump sum? [LS]

Work Retirement

Receive retirement lump sum Receive retirement lump sum

withdrawal benefit benefit (RLSB)

Circumstances? Circumstances?

- Quit or withdraw from fund - Reaches retirement age and

before retirement date retires.

- At liquidation

- Death (before retirement date)

Who pays out the lump sum?

Employer Private sector fund Public sector fund

s 1, GI, par (d) or (f) s 1, GI, par (e) s 1, GI, par (e) or (eA)

Includes gross amount Includes net amount. For (e): include net amount.

Severance benefit? Apply 2 nd Schedule. Apply 2 nd Schedule par 2A.

Yes: RLSB tax table Apply table for RLSB or Apply table for RLSB or RLS

No: normal tax table for RLS withdrawal withdrawal benefits.

NP benefits. If (eA), no 2 Schedule.

nd