Page 8 - P6 Slide Taxation - Lecture Day 6 - Retirement Benefits Lump Sums

P. 8

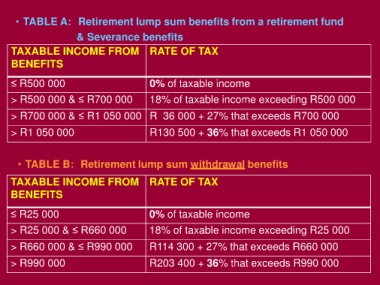

• TABLE A: Retirement lump sum benefits from a retirement fund

& Severance benefits

TAXABLE INCOME FROM RATE OF TAX

BENEFITS

≤ R500 000 0% of taxable income

> R500 000 & ≤ R700 000 18% of taxable income exceeding R500 000

> R700 000 & ≤ R1 050 000 R 36 000 + 27% that exceeds R700 000

> R1 050 000 R130 500 + 36% that exceeds R1 050 000

• TABLE B: Retirement lump sum withdrawal benefits

TAXABLE INCOME FROM RATE OF TAX

BENEFITS

≤ R25 000 0% of taxable income

> R25 000 & ≤ R660 000 18% of taxable income exceeding R25 000

> R660 000 & ≤ R990 000 R114 300 + 27% that exceeds R660 000

> R990 000 R203 400 + 36% that exceeds R990 000