Page 7 - P6 Slide Taxation - Lecture Day 6 - Retirement Benefits Lump Sums

P. 7

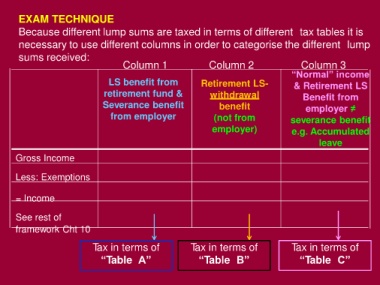

EXAM TECHNIQUE

Because different lump sums are taxed in terms of different tax tables it is

necessary to use different columns in order to categorise the different lump

sums received:

Column 1 Column 2 Column 3

“Normal” income

LS benefit from Retirement LS- & Retirement LS

retirement fund & withdrawal Benefit from

Severance benefit benefit employer ≠

from employer (not from severance benefit

employer) e.g. Accumulated

leave

Gross Income

Less: Exemptions

= Income

See rest of

framework Cht 10

Tax in terms of Tax in terms of Tax in terms of

“Table A” “Table B” “Table C”