Page 3 - FINAL CFA II SLIDES JUNE 2019 DAY 3

P. 3

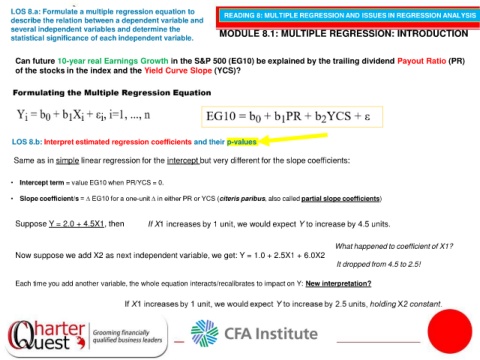

LOS 8.a: Formulate a multiple regression equation to READING 8: MULTIPLE REGRESSION AND ISSUES IN REGRESSION ANALYSIS

describe the relation between a dependent variable and

several independent variables and determine the MODULE 8.1: MULTIPLE REGRESSION: INTRODUCTION

statistical significance of each independent variable.

Can future 10-year real Earnings Growth in the S&P 500 (EG10) be explained by the trailing dividend Payout Ratio (PR)

of the stocks in the index and the Yield Curve Slope (YCS)?

LOS 8.b: Interpret estimated regression coefficients and their p-values

Same as in simple linear regression for the intercept but very different for the slope coefficients:

• Intercept term = value EG10 when PR/YCS = 0.

• Slope coefficient/s = ∆ EG10 for a one-unit ∆ in either PR or YCS (citeris paribus, also called partial slope coefficients)

Suppose Y = 2.0 + 4.5X1, then If X1 increases by 1 unit, we would expect Y to increase by 4.5 units.

What happened to coefficient of X1?

Now suppose we add X2 as next independent variable, we get: Y = 1.0 + 2.5X1 + 6.0X2

It dropped from 4.5 to 2.5!

Each time you add another variable, the whole equation interacts/recalibrates to impact on Y: New interpretation?