Page 187 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 187

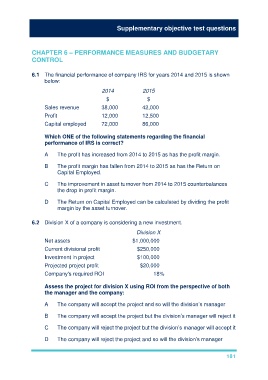

Supplementary objective test questions

CHAPTER 6 – PERFORMANCE MEASURES AND BUDGETARY

CONTROL

6.1 The financial performance of company IRS for years 2014 and 2015 is shown

below:

2014 2015

$ $

Sales revenue 38,000 42,000

Profit 12,000 12,500

Capital employed 72,000 86,000

Which ONE of the following statements regarding the financial

performance of IRS is correct?

A The profit has increased from 2014 to 2015 as has the profit margin.

B The profit margin has fallen from 2014 to 2015 as has the Return on

Capital Employed.

C The improvement in asset turnover from 2014 to 2015 counterbalances

the drop in profit margin.

D The Return on Capital Employed can be calculated by dividing the profit

margin by the asset turnover.

6.2 Division X of a company is considering a new investment.

Division X

Net assets $1,000,000

Current divisional profit $250,000

Investment in project $100,000

Projected project profit $20,000

Company's required ROI 18%

Assess the project for division X using ROI from the perspective of both

the manager and the company:

A The company will accept the project and so will the division’s manager

B The company will accept the project but the division’s manager will reject it

C The company will reject the project but the division’s manager will accept it

D The company will reject the project and so will the division’s manager

181