Page 195 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 195

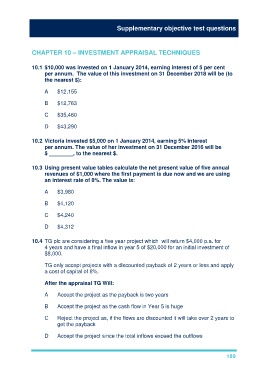

Supplementary objective test questions

CHAPTER 10 – INVESTMENT APPRAISAL TECHNIQUES

10.1 $10,000 was invested on 1 January 2014, earning interest of 5 per cent

per annum. The value of this investment on 31 December 2018 will be (to

the nearest $):

A $12,155

B $12,763

C $35,460

D $43,290

10.2 Victoria invested $5,000 on 1 January 2014, earning 5% interest

per annum. The value of her investment on 31 December 2016 will be

$ ________, to the nearest $.

10.3 Using present value tables calculate the net present value of five annual

revenues of $1,000 where the first payment is due now and we are using

an interest rate of 8%. The value is:

A $3,980

B $4,120

C $4,240

D $4,312

10.4 TG plc are considering a five year project which will return $4,000 p.a. for

4 years and have a final inflow in year 5 of $20,000 for an initial investment of

$8,000.

TG only accept projects with a discounted payback of 2 years or less and apply

a cost of capital of 8%.

After the appraisal TG Will:

A Accept the project as the payback is two years

B Accept the project as the cash flow in Year 5 is huge

C Reject the project as, if the flows are discounted it will take over 2 years to

get the payback

D Accept the project since the total inflows exceed the outflows

189