Page 197 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 197

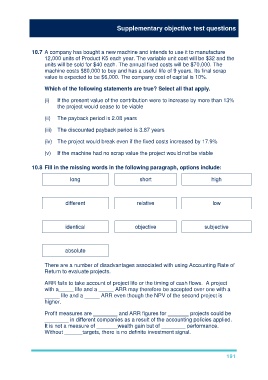

Supplementary objective test questions

10.7 A company has bought a new machine and intends to use it to manufacture

12,000 units of Product K5 each year. The variable unit cost will be $32 and the

units will be sold for $40 each. The annual fixed costs will be $70,000. The

machine costs $80,000 to buy and has a useful life of 9 years. Its final scrap

value is expected to be $6,000. The company cost of capital is 10%.

Which of the following statements are true? Select all that apply.

(i) If the present value of the contribution were to increase by more than 13%

the project would cease to be viable

(ii) The payback period is 2.08 years

(iii) The discounted payback period is 3.87 years

(iv) The project would break even if the fixed costs increased by 17.9%

(v) If the machine had no scrap value the project would not be viable

10.8 Fill in the missing words in the following paragraph, options include:

long short high

different relative low

identical objective subjective

absolute

There are a number of disadvantages associated with using Accounting Rate of

Return to evaluate projects.

ARR fails to take account of project life or the timing of cash flows. A project

with a_____ life and a _____ ARR may therefore be accepted over one with a

_____ life and a _____ ARR even though the NPV of the second project is

higher.

Profit measures are ________ and ARR figures for _______ projects could be

________ in different companies as a result of the accounting policies applied.

It is not a measure of _______wealth gain but of ________ performance.

Without ______targets, there is no definite investment signal.

191