Page 201 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 201

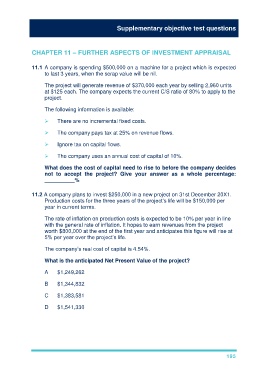

Supplementary objective test questions

CHAPTER 11 – FURTHER ASPECTS OF INVESTMENT APPRAISAL

11.1 A company is spending $500,000 on a machine for a project which is expected

to last 3 years, when the scrap value will be nil.

The project will generate revenue of $370,000 each year by selling 2,960 units

at $125 each. The company expects the current C/S ratio of 80% to apply to the

project.

The following information is available:

There are no incremental fixed costs.

The company pays tax at 25% on revenue flows.

Ignore tax on capital flows.

The company uses an annual cost of capital of 10%.

What does the cost of capital need to rise to before the company decides

not to accept the project? Give your answer as a whole percentage:

__________%

11.2 A company plans to invest $250,000 in a new project on 31st December 20X1.

Production costs for the three years of the project’s life will be $150,000 per

year in current terms.

The rate of inflation on production costs is expected to be 10% per year in line

with the general rate of inflation. It hopes to earn revenues from the project

worth $800,000 at the end of the first year and anticipates this figure will rise at

5% per year over the project’s life.

The company’s real cost of capital is 4.54%.

What is the anticipated Net Present Value of the project?

A $1,249,262

B $1,344,832

C $1,383,581

D $1,541,330

195