Page 203 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 203

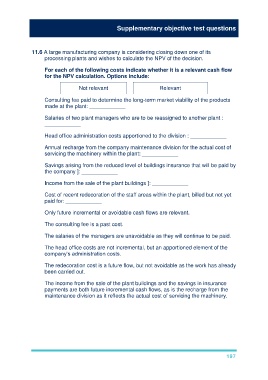

Supplementary objective test questions

11.6 A large manufacturing company is considering closing down one of its

processing plants and wishes to calculate the NPV of the decision.

For each of the following costs indicate whether it is a relevant cash flow

for the NPV calculation. Options include:

Not relevant Relevant

Consulting fee paid to determine the long-term market viability of the products

made at the plant: ____________

Salaries of two plant managers who are to be reassigned to another plant :

____________

Head office administration costs apportioned to the division : ____________

Annual recharge from the company maintenance division for the actual cost of

servicing the machinery within the plant: ____________

Savings arising from the reduced level of buildings insurance that will be paid by

the company ]: ____________

Income from the sale of the plant buildings ]: ____________

Cost of recent redecoration of the staff areas within the plant, billed but not yet

paid for: ____________

Only future incremental or avoidable cash flows are relevant.

The consulting fee is a past cost.

The salaries of the managers are unavoidable as they will continue to be paid.

The head office costs are not incremental, but an apportioned element of the

company’s administration costs.

The redecoration cost is a future flow, but not avoidable as the work has already

been carried out.

The income from the sale of the plant buildings and the savings in insurance

payments are both future incremental cash flows, as is the recharge from the

maintenance division as it reflects the actual cost of servicing the machinery.

197