Page 202 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 202

Subject P2: Advanced Management Accounting

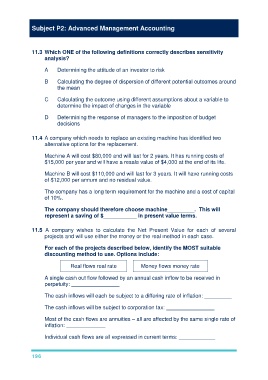

11.3 Which ONE of the following definitions correctly describes sensitivity

analysis?

A Determining the attitude of an investor to risk

B Calculating the degree of dispersion of different potential outcomes around

the mean

C Calculating the outcome using different assumptions about a variable to

determine the impact of changes in the variable

D Determining the response of managers to the imposition of budget

decisions

11.4 A company which needs to replace an existing machine has identified two

alternative options for the replacement.

Machine A will cost $80,000 and will last for 2 years. It has running costs of

$15,000 per year and will have a resale value of $4,000 at the end of its life.

Machine B will cost $110,000 and will last for 3 years. It will have running costs

of $12,000 per annum and no residual value.

The company has a long term requirement for the machine and a cost of capital

of 10%.

The company should therefore choose machine_________. This will

represent a saving of $___________ in present value terms.

11.5 A company wishes to calculate the Net Present Value for each of several

projects and will use either the money or the real method in each case.

For each of the projects described below, identify the MOST suitable

discounting method to use. Options include:

Real flows real rate Money flows money rate

A single cash out flow followed by an annual cash inflow to be received in

perpetuity: ________________

The cash inflows will each be subject to a differing rate of inflation: _________

The cash inflows will be subject to corporation tax: ________________

Most of the cash flows are annuities – all are affected by the same single rate of

inflation: _____________

Individual cash flows are all expressed in current terms: ____________

196