Page 194 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 194

Subject P2: Advanced Management Accounting

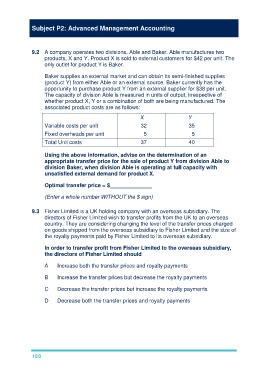

9.2 A company operates two divisions, Able and Baker. Able manufactures two

products, X and Y. Product X is sold to external customers for $42 per unit. The

only outlet for product Y is Baker.

Baker supplies an external market and can obtain its semi-finished supplies

(product Y) from either Able or an external source. Baker currently has the

opportunity to purchase product Y from an external supplier for $38 per unit.

The capacity of division Able is measured in units of output, irrespective of

whether product X, Y or a combination of both are being manufactured. The

associated product costs are as follows:

X Y

Variable costs per unit 32 35

Fixed overheads per unit 5 5

Total Unit costs 37 40

Using the above information, advise on the determination of an

appropriate transfer price for the sale of product Y from division Able to

division Baker, when division Able is operating at full capacity with

unsatisfied external demand for product X.

Optimal transfer price = $______________

(Enter a whole number WITHOUT the $ sign)

9.3 Fisher Limited is a UK holding company with an overseas subsidiary. The

directors of Fisher Limited wish to transfer profits from the UK to an overseas

country. They are considering changing the level of the transfer prices charged

on goods shipped from the overseas subsidiary to Fisher Limited and the size of

the royalty payments paid by Fisher Limited to its overseas subsidiary.

In order to transfer profit from Fisher Limited to the overseas subsidiary,

the directors of Fisher Limited should

A Increase both the transfer prices and royalty payments

B Increase the transfer prices but decrease the royalty payments

C Decrease the transfer prices but increase the royalty payments

D Decrease both the transfer prices and royalty payments

188