Page 221 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 221

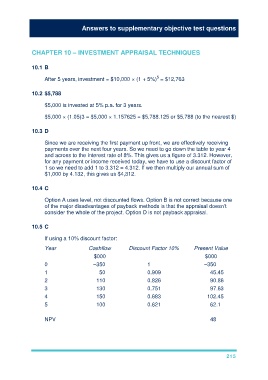

Answers to supplementary objective test questions

CHAPTER 10 – INVESTMENT APPRAISAL TECHNIQUES

10.1 B

5

After 5 years, investment = $10,000 × (1 + 5%) = $12,763

10.2 $5,788

$5,000 is invested at 5% p.a. for 3 years.

$5,000 × (1.05)3 = $5,000 × 1.157625 = $5,788.125 or $5,788 (to the nearest $)

10.3 D

Since we are receiving the first payment up front, we are effectively receiving

payments over the next four years. So we need to go down the table to year 4

and across to the interest rate of 8%. This gives us a figure of 3.312. However,

for any payment or income received today, we have to use a discount factor of

1 so we need to add 1 to 3.312 = 4.312. If we then multiply our annual sum of

$1,000 by 4.132, this gives us $4,312.

10.4 C

Option A uses level, not discounted flows. Option B is not correct because one

of the major disadvantages of payback methods is that the appraisal doesn’t

consider the whole of the project. Option D is not payback appraisal.

10.5 C

If using a 10% discount factor:

Year Cashflow Discount Factor 10% Present Value

$000 $000

0 –350 1 –350

1 50 0.909 45.45

2 110 0.826 90.86

3 130 0.751 97.63

4 150 0.683 102.45

5 100 0.621 62.1

NPV 48

215