Page 216 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 216

Subject P2: Advanced Management Accounting

CHAPTER 6 – PERFORMANCE MEASURES & BUDGETARY

CONTROL

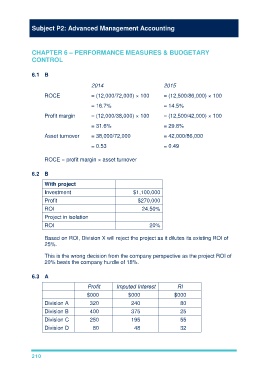

6.1 B

2014 2015

ROCE = (12,000/72,000) × 100 = (12,500/86,000) × 100

= 16.7% = 14.5%

Profit margin = (12,000/38,000) × 100 = (12,500/42,000) × 100

= 31.6% = 29.8%

Asset turnover = 38,000/72,000 = 42,000/86,000

= 0.53 = 0.49

ROCE = profit margin × asset turnover

6.2 B

With project

Investment $1,100,000

Profit $270,000

ROI 24.50%

Project in isolation

ROI 20%

Based on ROI, Division X will reject the project as it dilutes its existing ROI of

25%.

This is the wrong decision from the company perspective as the project ROI of

20% beats the company hurdle of 18%.

6.3 A

Profit Imputed Interest RI

$000 $000 $000

Division A 320 240 80

Division B 400 375 25

Division C 250 195 55

Division D 80 48 32

210