Page 223 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 223

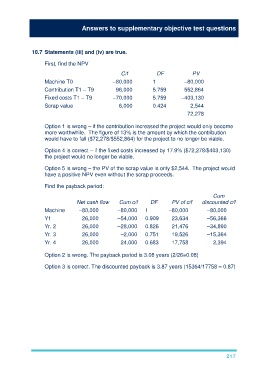

Answers to supplementary objective test questions

10.7 Statements (iii) and (iv) are true.

First, find the NPV

C/f DF PV

Machine T0 –80,000 1 –80,000

Contribution T1 – T9 96,000 5.759 552,864

Fixed costs T1 – T9 –70,000 5.759 –403,130

Scrap value 6,000 0.424 2,544

72,278

Option 1 is wrong – if the contribution increased the project would only become

more worthwhile. The figure of 13% is the amount by which the contribution

would have to fall ($72,278/$552,864) for the project to no longer be viable.

Option 4 is correct – if the fixed costs increased by 17.9% ($72,278/$403,130)

the project would no longer be viable.

Option 5 is wrong – the PV of the scrap value is only $2,544. The project would

have a positive NPV even without the scrap proceeds.

Find the payback period:

Cum

Net cash flow Cum c/f DF PV of c/f discounted c/f

Machine –80,000 –80,000 1 –80,000 –80,000

Y1 26,000 –54,000 0.909 23,634 –56,366

Yr. 2 26,000 –28,000 0.826 21,476 –34,890

Yr. 3 26,000 –2,000 0.751 19,526 –15,364

Yr. 4 26,000 24,000 0.683 17,758 2,394

Option 2 is wrong. The payback period is 3.08 years (2/26=0.08)

Option 3 is correct. The discounted payback is 3.87 years (15364/17758 = 0.87)

217