Page 228 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 228

Subject P2: Advanced Management Accounting

CHAPTER 11 – FURTHER ASPECTS OF INVESTMENT APPRAISAL

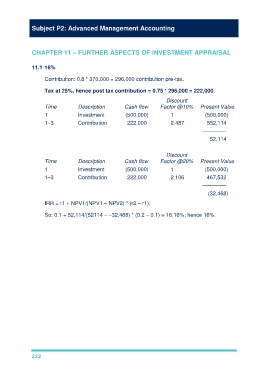

11.1 16%

Contribution: 0.8 * 370,000 = 296,000 contribution pre-tax.

Tax at 25%, hence post tax contribution = 0.75 * 296,000 = 222,000.

Discount

Time Description Cash flow Factor @10% Present Value

1 Investment (500,000) 1 (500,000)

1–3 Contribution 222,000 2.487 552,114

––––––––

52,114

Discount

Time Description Cash flow Factor @20% Present Value

1 Investment (500,000) 1 (500,000)

1–3 Contribution 222,000 2.106 467,532

––––––––

(32,468)

IRR = r1 + NPV1/(NPV1 – NPV2) * (r2 – r1);

So: 0.1 + 52,114/(52114 – –32,468) * (0.2 – 0.1) = 16.16%; hence 16%.

222