Page 231 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 231

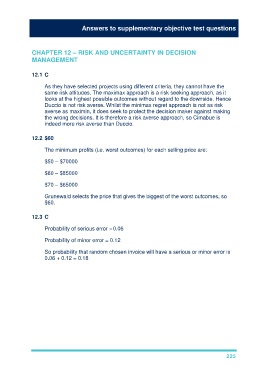

Answers to supplementary objective test questions

CHAPTER 12 – RISK AND UNCERTAINTY IN DECISION

MANAGEMENT

12.1 C

As they have selected projects using different criteria, they cannot have the

same risk attitudes. The maximax approach is a risk seeking approach, as it

looks at the highest possible outcomes without regard to the downside. Hence

Duccio is not risk averse. Whilst the minimax regret approach is not as risk

averse as maximin, it does seek to protect the decision maker against making

the wrong decisions. It is therefore a risk averse approach, so Cimabue is

indeed more risk averse than Duccio.

12.2 $60

The minimum profits (i.e. worst outcomes) for each selling price are:

$50 – $70000

$60 – $85000

$70 – $65000

Grunewald selects the price that gives the biggest of the worst outcomes, so

$60.

12.3 C

Probability of serious error = 0.06

Probability of minor error = 0.12

So probability that random chosen invoice will have a serious or minor error is

0.06 + 0.12 = 0.18

225