Page 12 - CIMA OCS August 2018 Day 1 Suggested Solutions

P. 12

CIMA AUGUST 2018 – OPERATIONAL CASE STUDY

CHAPTER SIX – F1

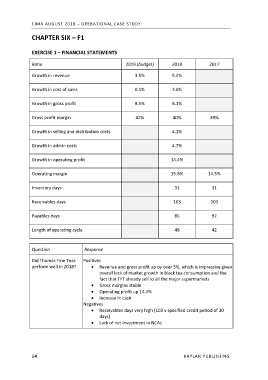

EXERCISE 1 – FINANCIAL STATEMENTS

Ratio 2019 (budget) 2018 2017

Growth in revenue 3.5% 5.4%

Growth in cost of sales 0.1% 3.6%

Growth in gross profit 8.5% 8.1%

Gross profit margin 42% 40% 39%

Growth in selling and distribution costs 4.1%

Growth in admin costs 4.7%

Growth in operating profit 14.4%

Operating margin 15.8% 14.5%

Inventory days 31 31

Receivables days 103 103

Payables days 85 92

Length of operating cycle 49 42

Question Response

Did Thomas Fine Teas Positives

perform well in 2018? • Revenue and gross profit up by over 5%, which is impressive given

overall lack of market growth in black tea consumption and the

fact that TFT already sell to all the major supermarkets

• Gross margins stable

• Operating profit up 14.4%

• Increase in cash

Negatives

• Receivables days very high (103 v specified credit period of 30

days)

• Lack of net investment in NCAs

54 KAPLAN PUBLISHING