Page 8 - CIMA OCS August 2018 Day 1 Suggested Solutions

P. 8

CIMA AUGUST 2018 – OPERATIONAL CASE STUDY

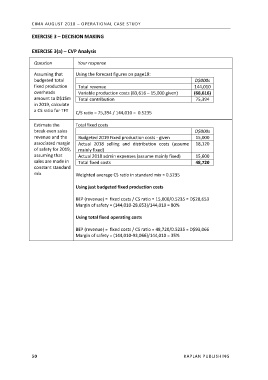

EXERCISE 3 – DECISION MAKING

EXERCISE 3(a) – CVP Analysis

Question Your response

Assuming that Using the forecast figures on page19:

budgeted total D$000s

fixed production Total revenue 144,010

overheads Variable production costs (83,616 – 15,000 given) (68,616)

amount to D$15m Total contribution 75,394

in 2019, calculate

a CS ratio for TFT

C/S ratio = 75,394 / 144,010 = 0.5235

Estimate the Total fixed costs

break even sales D$000s

revenue and the Budgeted 2019 Fixed production costs - given 15,000

associated margin Actual 2018 selling and distribution costs (assume 18,120

of safety for 2019, mainly fixed)

assuming that Actual 2018 admin expenses (assume mainly fixed) 15,600

sales are made in Total fixed costs 48,720

constant standard

mix Weighted average CS ratio in standard mix = 0.5235

Using just budgeted fixed production costs

BEP (revenue) = fixed costs / CS ratio = 15,000/0.5235 = D$28,653

Margin of safety = (144,010-28,653)/144,010 = 80%

Using total fixed operating costs

BEP (revenue) = fixed costs / CS ratio = 48,720/0.5235 = D$93,066

Margin of safety = (144,010-93,066)/144,010 = 35%

50 KAPLAN PUBLISHING