Page 8 - IT_June_2020_Classical

P. 8

BACK TO

BUSINESS

Executives anticipate multi-year

recovery is most likely scenario

CHINA IS BANKING ON A FAST, FORCEFUL RESPONSE TO THE COVID-19 OUTBREAK, LOOKING FOR A

V-SHAPED REBOUND AFTER THE 7% WALLOP TO ITS GDP IN THE FIRST QUARTER OF THE YEAR. THE

TRAJECTORY IS AMONG NINE ECONOMIC RECOVERY SCENARIOS MCKINSEY & COMPANY PRESENTED

TO MORE THAN 2,000 EXECUTIVES WORLDWIDE IN A RECENT SURVEY SEEKING THEIR VIEWS ON THE

LIKELIHOOD OF EACH. HERE WE LOOK AT THE RESULTS, WITH HINTS OF THE FUTURE FOR THE UK

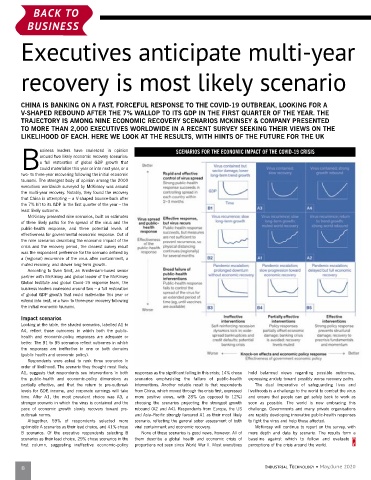

usiness leaders have coalesced in opinion SCENARIOS FOR THE ECONOMIC IMPACT OF THE COVID-19 CRISIS

around two likely economic recovery scenarios:

a full restoration of global GDP growth that

Bcould materialise this year or into next year, or a

two- to three-year recovering following the initial economic

tsunami. The strongest body of opinion among the 2000

executives worldwide surveyed by McKinsey was around

the multi-year recovery. Notably, they found the recovery

that China is attempting – a V-shaped bounce-back after

the 7% hit to its GDP in the first quarter of the year – the

least likely outcome.

McKinsey presented nine scenarios, built on estimates

of three likely paths for the spread of the virus and the

public-health response, and three potential levels of

effectiveness for governmental economic response. Out of

the nine scenarios describing the economic impact of the

crisis and the recovery period, the clearest survey result

was the respondent preference for the scenario defined by

a (regional) recurrence of the virus after containment, a

muted recovery, and slower long-term growth.

According to Sven Smit, an Amsterdam-based senior

partner with McKinsey and global leader of the McKinsey

Global Institute and global Covid-19 response team, the

business leaders coalesced around two – a full restoration

of global GDP growth that could materialise this year or

extend into next, or a two- to three-year recovery following

the initial economic tsunami.

Impact scenarios

Looking at the table, the shaded scenarios, labelled A1 to

A4, reflect those outcomes in which both the public-

health and economic-policy responses are adequate or

better. The B1 to B5 scenarios reflect outcomes in which

the responses are ineffective in one or both domains

(public health and economic policy).

Respondents were asked to rank three scenarios in

order of likelihood. The scenario they thought most likely,

A1, suggests that respondents see interventions in both responses as the significant failing in this crisis; 14% chose hold balanced views regarding possible outcomes,

the public-health and economic-policy dimensions as scenarios emphasising the failure of public-health expressing anxiety toward possibly worse recovery paths.

partially effective, and that the return to pre-outbreak interventions. Another notable result is that respondents The dual imperative of safeguarding lives and

levels for GDP, income, and corporate earnings will take from China, which moved through the crisis first, expressed livelihoods is a challenge to the world to combat the virus

time. After A1, the most prevalent choice was A3, a more positive views, with 28% (as opposed to 12%) and ensure that people can get safely back to work as

stronger scenario in which the virus is contained and the choosing the scenarios projecting the strongest growth soon as possible. The world is now embracing this

pace of economic growth slowly recovers toward pre- rebound (A2 and A4). Respondents from Europe, the US challenge. Governments and many private organisations

outbreak norms. and Asia–Pacific strongly favoured A1 as their most likely are rapidly developing innovative public-health responses

Altogether, 59% of respondents selected more scenario, reflecting the general sober assessment of both to fight the virus and help those affected.

optimistic A scenarios as their lead choice, and 41% chose viral containment and economic recovery. McKinsey will continue to report on the survey, with

B scenarios. Of the executive respondents selecting B None of these scenarios is good news, however. All of more depth and data by scenario. The results form a

scenarios as their lead choice, 29% chose scenarios in the them describe a global health and economic crisis of baseline against which to follow and evaluate

first column, suggesting ineffective economic-policy proportions not seen since World War II. Most executives perceptions of the crisis around the world.

8 INDUSTRIAL TECHNOLOGY • May/June 2020