Page 17 - Trident 2022 Flipbook

P. 17

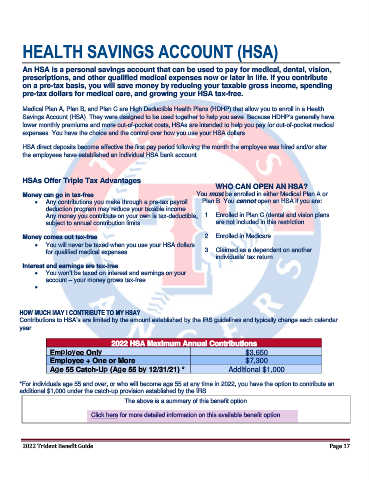

HEALTH SAVINGS ACCOUNT (HSA)

An HSA is a personal savings account that can be used to pay for medical, dental, vision,

prescriptions, and other qualified medical expenses now or later in life. If you contribute

on a pre-tax basis, you will save money by reducing your taxable gross income, spending

pre-tax dollars for medical care, and growing your HSA tax-free.

Medical Plan A, Plan B, and Plan C are High Deductible Health Plans (HDHP) that allow you to enroll in a Health

Savings Account (HSA). They were designed to be used together to help you save. Because HDHP’s generally have

lower monthly premiums and more out-of-pocket costs, HSAs are intended to help you pay for out-of-pocket medical

expenses. You have the choice and the control over how you use your HSA dollars.

HSA direct deposits become effective the first pay period following the month the employee was hired and/or after

the employees have established an individual HSA bank account.

HSAs Offer Triple Tax Advantages

WHO CAN OPEN AN HSA?

Money can go in tax-free You must be enrolled in either Medical Plan A or

• Any contributions you make through a pre-tax payroll Plan B. You cannot open an HSA if you are:

deduction program may reduce your taxable income.

Any money you contribute on your own is tax-deductible, 1. Enrolled in Plan C (dental and vision plans

subject to annual contribution limits. are not included in this restriction.

Money comes out tax-free 2. Enrolled in Medicare.

• You will never be taxed when you use your HSA dollars

for qualified medical expenses. 3. Claimed as a dependent on another

individuals’ tax return.

Interest and earnings are tax-free

• You won’t be taxed on interest and earnings on your

account – your money grows tax-free.

•

HOW MUCH MAY I CONTRIBUTE TO MY HSA?

Contributions to HSA’s are limited by the amount established by the IRS guidelines and typically change each calendar

year.

2022 HSA Maximum Annual Contributions

Employee Only $3,650

Employee + One or More $7,300

Age 55 Catch-Up (Age 55 by 12/31/21) * Additional $1,000

*For individuals age 55 and over, or who will become age 55 at any time in 2022, you have the option to contribute an

additional $1,000 under the catch-up provision established by the IRS.

The above is a summary of this benefit option.

Click here for more detailed information on this available benefit option.

2022 Trident Benefit Guide Page 17