Page 5 - 2022 Drive Open Enrollment Guide - Non Union

P. 5

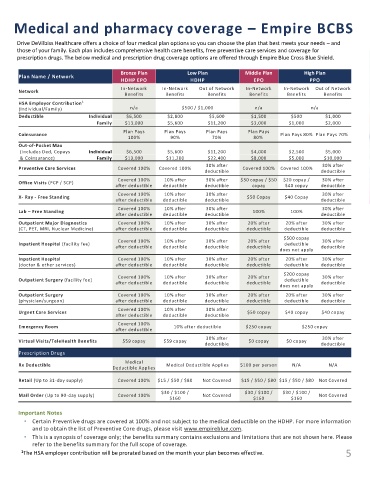

Medical and pharmacy coverage – Empire BCBS

Drive DeVilbiss Healthcare offers a choice of four medical plan options so you can choose the plan that best meets your needs – and

those of your family. Each plan includes comprehensive health care benefits, free preventive care services and coverage for

prescription drugs. The below medical and prescription drug coverage options are offered through Empire Blue Cross Blue Shield.

Bronze Plan Low Plan Middle Plan High Plan

Plan Name / Network

HDHP EPO HDHP EPO PPO

In-Network In-Network Out of Network In-Network In-Network Out of Network

Network

Benefits Benefits Benefits Benefits Benefits Benefits

HSA Employer Contribution 1

(Individual/Family) n/a $500 / $1,000 n/a n/a

Deductible Individual $6,500 $2,800 $5,600 $1,500 $500 $1,000

Family $13,000 $5,600 $11,200 $3,000 $1,000 $2,000

Plan Pays Plan Pays Plan Pays Plan Pays

Coinsurance Plan Pays 80% Plan Pays 70%

100% 90% 70% 80%

Out-of-Pocket Max

(Includes Ded, Copays Individual $6,500 $5,600 $11,200 $4,000 $2,500 $5,000

& Coinsurance) Family $13,000 $11,200 $22,400 $8,000 $5,000 $10,000

30% after 30% after

Preventive Care Services Covered 100% Covered 100% Covered 100% Covered 100%

deductible deductible

Covered 100% 10% after 30% after $30 copay / $50 $20 copay / 30% after

Office Visits (PCP / SCP)

after deductible deductible deductible copay $40 copay deductible

Covered 100% 10% after 30% after 30% after

X- Ray - Free Standing $50 Copay $40 Copay

after deductible deductible deductible deductible

Covered 100% 10% after 30% after 30% after

Lab – Free Standing 100% 100%

after deductible deductible deductible deductible

Outpatient Major Diagnostics Covered 100% 10% after 30% after 20% after 20% after 30% after

(CT, PET, MRI, Nuclear Medicine) after deductible deductible deductible deductible deductible deductible

$500 copay

Covered 100% 10% after 30% after 20% after 30% after

Inpatient Hospital (facility fee) deductible

after deductible deductible deductible deductible deductible

does not apply

Inpatient Hospital Covered 100% 10% after 30% after 20% after 20% after 30% after

(doctor & other services) after deductible deductible deductible deductible deductible deductible

$200 copay

Covered 100% 10% after 30% after 20% after 30% after

Outpatient Surgery (facility fee) deductible

after deductible deductible deductible deductible deductible

does not apply

Outpatient Surgery Covered 100% 10% after 30% after 20% after 20% after 30% after

(physician/surgeon) after deductible deductible deductible deductible deductible deductible

Covered 100% 10% after 30% after

Urgent Care Services $50 copay $40 copay $40 copay

after deductible deductible deductible

Covered 100%

Emergency Room 10% after deductible $250 copay $250 copay

after deductible

30% after 30% after

Virtual Visits/TeleHealth Benefits $59 copay $59 copay $0 copay $0 copay

deductible deductible

Prescription Drugs

Medical

Rx Deductible Medical Deductible Applies $100 per person N/A N/A

Deductible Applies

Retail (Up to 31-day supply) Covered 100% $15 / $50 / $80 Not Covered $15 / $50 / $80 $15 / $50 / $80 Not Covered

$30 / $100 / $30 / $100 / $30 / $100 /

Mail Order (Up to 90-day supply) Covered 100% Not Covered Not Covered

$160 $160 $160

Important Notes

• Certain Preventive drugs are covered at 100% and not subject to the medical deductible on the HDHP. For more information

and to obtain the list of Preventive Core drugs, please visit www.empireblue.com.

• This is a synopsis of coverage only; the benefits summary contains exclusions and limitations that are not shown here. Please

refer to the benefits summary for the full scope of coverage.

1 The HSA employer contribution will be prorated based on the month your plan becomes effective. 5