Page 14 - 2022 Infoblox Benefits Guide

P. 14

Spending Income Optional

Spending

Accounts

Contents Eligibility Medical Contributions Dental Vision A c c oun ts Protection Benefits Contacts

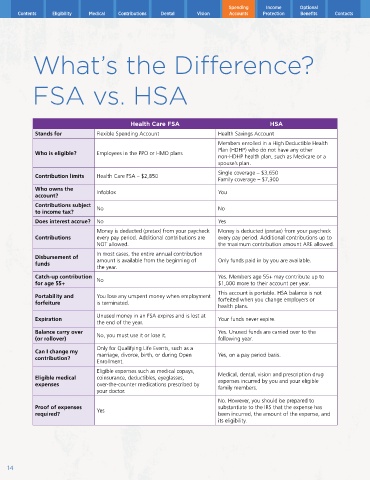

What’s the Difference?

FSA vs. HSA

Health Care FSA HSA

Stands for Flexible Spending Account Health Savings Account

Members enrolled in a High Deductible Health

Plan (HDHP) who do not have any other

Who is eligible? Employees in the PPO or HMO plans

non-HDHP health plan, such as Medicare or a

spouse’s plan.

Single coverage – $3,650

Contribution limits Health Care FSA – $2,850

Family coverage – $7,300

Who owns the

account? Infoblox You

Contributions subject

to income tax? No No

Does interest accrue? No Yes

Money is deducted (pretax) from your paycheck Money is deducted (pretax) from your paycheck

Contributions every pay period. Additional contributions are every pay period. Additional contributions up to

NOT allowed. the maximum contribution amount ARE allowed.

In most cases, the entire annual contribution

Disbursement of

funds amount is available from the beginning of Only funds paid in by you are available.

the year.

Catch-up contribution Yes. Members age 55+ may contribute up to

for age 55+ No $1,000 more to their account per year.

This account is portable. HSA balance is not

Portability and You lose any unspent money when employment

forfeiture is terminated. forfeited when you change employers or

health plans.

Unused money in an FSA expires and is lost at

Expiration Your funds never expire.

the end of the year.

Balance carry over Yes. Unused funds are carried over to the

(or rollover) No, you must use it or lose it. following year.

Only for Qualifying Life Events, such as a

Can I change my marriage, divorce, birth, or during Open Yes, on a pay period basis.

contribution?

Enrollment.

Eligible expenses such as medical copays,

Eligible medical coinsurance, deductibles, eyeglasses, Medical, dental, vision and prescription drug

expenses over-the-counter medications prescribed by expenses incurred by you and your eligible

your doctor. family members.

No. However, you should be prepared to

Proof of expenses Yes substantiate to the IRS that the expense has

required? been incurred, the amount of the expense, and

its eligibility.

14