Page 11 - FP-Sample-Flipbook

P. 11

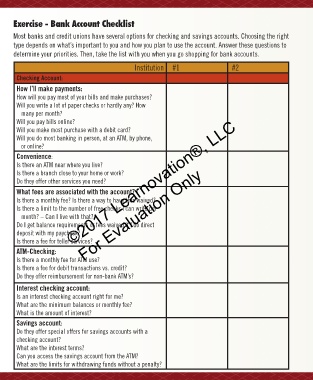

Key Terms You Need to Know: The Magic of Interest Exercise - Bank Account Checklist

Check: written paper showing the amount of When you use someone else’s money, you have Most banks and credit unions have several options for checking and savings accounts. Choosing the right

money to be paid and the name of the person or to pay for it. The fee for borrowing money is called type depends on what’s important to you and how you plan to use the account. Answer these questions to

company who should receive the money. interest. When you put money in a savings account you determine your priorities. Then, take the list with you when you go shopping for bank accounts.

Debit card: a card that allows the user to withdraw are loaning the bank your money to use. They pay you a Institution #1 #2

money from a bank account to obtain cash or make set interest rate. Suppose you put $500 into a savings Checking Account:

a purchase like a credit card. account that was paying 3% interest each year. The How I’ll make payments:

bank says it will pay part of that 3% each month or

Automated Teller Machine (ATM): a machine that .25% per month. (3% divided by 12 months.) How will you pay most of your bills and make purchases?

allows you to use your debit card to perform basic Will you write a lot of paper checks or hardly any? How

banking functions without the help of a teller. At the end of the month, the bank would add $1.25 to many per month?

©2017 Learnovation®, LLC

your account, for a total of $501.25. If you leave the Will you pay bills online?

Online banking: access your account information, interest in the account, called compounding, it adds to Will you make most purchase with a debit card?

view transaction history, and perform banking the total saved, or principal. In the next month you earn Will you do most banking in person, at an ATM, by phone,

transactions via the Internet. interest on that as well. So .25% of $501.25 is $1.25. or online?

Direct deposit: your paycheck is automatically Now you have $502.50. Keep this up, and by the end of Convenience:

deposited into your account. You don’t receive a the year you’ll have make $15.21 and you didn’t lift a Is there an ATM near where you live?

physical check, just a statement. finger! What would happen if you decided to add just Is there a branch close to your home or work?

Minimum account balance: the amount of money $20 per month to your account? By the end of the year Do they offer other services you need?

you must keep in the account to avoid service you’d have $758. What fees are associated with the account?

Is there a monthly fee? Is there a way to have this waived?

charges, qualify for special services, or earn It may not seem like much at the beginning, but the Is there a limit to the number of free checks I can write per

interest on the checking account. longer you save the more of an impact compound Is there a monthly fee for ATM use? For Evaluation Only

month? – Can I live with that?

interest makes. Early savings is the key. Do I get balance requirements or fees waived if I do direct

The Habit of Saving deposit with my paycheck?

Is there a fee for teller services?

Interest rates on savings accounts are at an all-time low, many paying less than 1%. You’re not going to ATM-Checking:

get rich putting your money in a savings account. What you are doing is building good habits of money

management, learning to save Is there a fee for debit transactions vs. credit?

money for a goal instead of spending Do they offer reimbursement for non-bank ATM’s?

what you have. On payday, the first Interest checking account:

thing you should do is pay yourself. Is an interest checking account right for me?

Put money into your savings account What are the minimum balances or monthly fee?

and don’t touch it. Pretend your What is the amount of interest?

savings account doesn’t exist. Savings account:

Resist the temptation to take it out Do they offer special offers for savings accounts with a

and spend it right away. Get excited checking account?

about watching the balance in the What are the interest terms?

account grow each month. Can you access the savings account from the ATM?

What are the limits for withdrawing funds without a penalty?