Page 7 - FP-Sample-Flipbook

P. 7

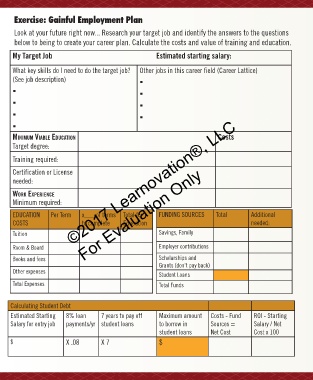

Exercise: Gainful Employment Plan

Identify Your Target Job Finding the GAPs

If you want to build your income over your lifetime, Once you’ve researched your target job, look at the Look at your future right now... Research your target job and identify the answers to the questions

below to being to create your career plan. Calculate the costs and value of training and education.

you need to have a career plan, and that starts skill sets you have now and find the gaps. What

by identifying a target job. Look at your interests, additional knowledge, skills, abilities, experience, My Target Job Estimated starting salary:

talents, and current skills, and decide what kind of and education do you need to get this job?

job you’d like to have. What key skills do I need to do the target job? Other jobs in this career field (Career Lattice)

(See job description)

Use www.onetonline.org to research the career

field and identify the job requirements and

skills needed.

Are there other jobs you’ll do before you can

advance to the target job? A career lattice If you need a special degree or certification,

is used to map out different ways to reach research the schools that provide the training. MiniMuM Viable education Costs

your target job. You might build your career Calculate the time and costs to get the Target degree:

by advancing up in a company, or switching education you need, then compare the

between different jobs, positions, and fields to schools that offer the training. Find the best Training required:

reach your target goal. value for your money. Go online to bigfuture. Certification or License

Compare salaries for positions in different collegeboard.org to compare college costs. needed: ©2017 Learnovation®, LLC

geographic locations. Will you make enough Are there part-time jobs or community service

income to support the lifestyle you want? opportunities that can help you build skills Work experience

Minimum required:

Explore ways to advance on the needed in your target job? Make a choice to For Evaluation Only Total Additional

FUNDING SOURCES

job with a specific education build your skills when you can. EDUCATION Per Term x___ of terms Total for needed:

to complete

Education

COSTS

course, certificate, or degree. Stop and take a realistic look at the Tuition Savings, Family

Can you take the skills from target job. Is it worth the investment of

this job and apply them to a your time and resources? Look closely at job Room & Board Employer contributions

different field of work? Are they prospects and career salaries. Books and fees Scholarships and

transferable to other areas? Grants (don’t pay back)

Other expenses Student Loans

Invest in Yourself - It Pays the Best Interest Total Expenses Total Funds

As education costs and student debt grow higher each year, people are focusing on the jobs they want, the

amount they are borrowing to get their education, and how to get more value for their money. Before you Calculating Student Debt

start any education program or training, calculate the Return on Investment (ROI) on your education. You Estimated Starting 8% loan 7 years to pay off Maximum amount Costs - Fund ROI - Starting

should look at what it will cost to get your degree (the expenses) and what it will be worth to you in your Salary for entry job payments/yr student loans to borrow in Sources = Salary / Net

career (potential income). Some jobs will take longer to pay off, but may have a bigger payout in the long student loans Net Cost Cost x 100

run. By calculating ROI you can really see whether your investment in time, energy and money justifies the $ X .08 X 7 $

payoff. Here’s the basic formula: ROI = Income / Investment * 100. Make sure that any training you take

is a good investment and lead to gainful employment.