Page 12 - FP-Sample-Flipbook

P. 12

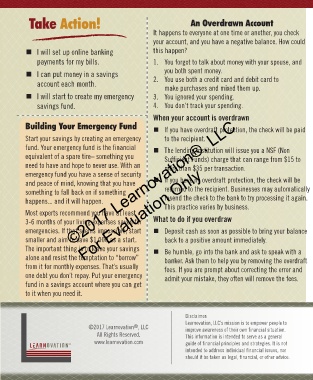

Take Action! An Overdrawn Account

It happens to everyone at one time or another, you check A checking Benefits of Setting

your account, and you have a negative balance. How could account is one of Up a Checking Financial

I will set up online banking this happen? the most basic Literacy

payments for my bills. 1. You forgot to talk about money with your spouse, and of all financial Account No. 3

I can put money in a savings you both spent money. services. With Direct deposit of

account each month. 2. You use both a credit card and debit card to a checking payroll checks from

make purchases and mixed them up.

I will start to create my emergency 3. You ignored your spending. account, you can give work.

savings fund. 4. You don’t track your spending. money to another person or business when Pay bills and schedule

it is not safe or practical to give them cash.

©2017 Learnovation®, LLC

When your account is overdrawn Today’s checking accounts offer a wide range them online.

Building Your Emergency Fund If you have overdraft protection, the check will be paid of banking options from debit cards that are Automatically receive

Start your savings by creating an emergency to the recipient. accepted like credit cards, to online banking child support,

fund. Your emergency fund is the financial The lending institution will issue you a NSF (Non and bill pay, checks, online transfers, and disability, or other

equivalent of a spare tire– something you Sufficient Funds) charge that can range from $15 to money management software. Checking scheduled payments

need to have and hope to never use. With an more than $35 per transaction. accounts make paying bills and tracking into your account.

For Evaluation Only

emergency fund you have a sense of security

and peace of mind, knowing that you have If you have no overdraft protection, the check will be personal spending habits simple and A check provides proof

something to fall back on if something returned to the recipient. Businesses may automatically convenient. of payment versus Accounts Checking & Savings

happens... and it will happen. resend the check to the bank to try processing it again. A savings account is used to put money away cash.

This practice varies by business.

Most experts recommend you have at least for use at a later time. Banks pay you interest Check cashing services

3-6 months of your living expenses saved for What to do if you overdraw for the use of your money while you save. are available for free or

emergencies. If that seems impossible, start Deposit cash as soon as possible to bring your balance Savings accounts are used to save money from a low fee.

smaller and aim to save $1,000 as a start. back to a positive amount immediately. a paycheck towards a major purchase like a

The important thing is to leave your savings Be humble, go into the bank and ask to speak with a car, and to have an emergency fund when you

alone and resist the temptation to “borrow” banker. Ask them to help you by removing the overdraft encounter unexpected expenses.

from it for monthly expenses. That’s usually fees. If you are prompt about correcting the error and

one debt you don’t repay. Put your emergency admit your mistake, they often will remove the fees.

fund in a savings account where you can get Money Matters

to it when you need it.

8 You can only write checks for the money that is in your account.

Disclaimer: 8 Use online banking to schedule automatic payment of your bills.

Learnovation, LLC’s mission is to empower people to

®

©2017 Learnovation , LLC improve awareness of their own financial situation. Save fees by using your own bank’s ATM machine. You may be charged

All Rights Reserved. This information is intended to serve as a general 8

www.learnovation.com guide of financial principles and strategies. It is not $2- $4 each time you use another bank’s ATM.

intended to address individual financial issues, nor Start saving as soon as you can.

should it be taken as legal, financial, or other advice. 8

8 70% of consumers live paycheck to paycheck.