Page 228 - BCML AR 2019-20

P. 228

FINANCIAL STATEMENTS

Notes forming part of the Standalone Financial Statements

Note No. : 36 Other disclosures (contd.)

(iii) Commodity price risk

The major segment in which the Company operates, which accounts for around 80% of the Company’s revenues, is Sugar

and as such the Company is exposed to commodity price risk. Normally, Company does not physically export sugar unless

it is mandated by the Government and duly supported by export subsidy. In that case, the Company has a policy in place

to hedge the export underlying exposure. For domestic sales, under the current regime, sales quotas are announced by the

Government on monthly basis.

Further, there are not many active platforms in India that allow hedging of domestic sugar sales. In addition to the above, the

Central Government had announced Minimum Sale Price (MSP) for sale of sugar in the open market by every sugar mill. Such

MSP, currently at H 31/- per kilogram acts as a minimum floor price for the sale of sugar by the sugar mills in India. The pricing

methodology for ethanol also remained unchanged. Ethanol prices are announced annually by the Central Government

based on a formula, which considers the price of sugar and FRP of sugarcane to calculate the ethanol procurement prices.

The ethanol prices are delinked with the crude or petrol prices. Thus, there is no price risk in case of ethanol and accordingly

it does not require any hedging.

(iv) Other price risk

Company’s equity risk exposure is limited to cost and these are subject to impairment testing as per the policies followed in

this respect. Accordingly, other price risk is not expected to be material.

(b) Credit risk

Credit risk is the risk that counterparty will not meet its obligations under a financial instrument or customer contract, leading to a

financial loss. The Company’s sugar sales are mostly on cash. Power and ethanol are sold to government entities, thereby the credit

default risk is significantly mitigated.

The Company uses judgement in making these assumptions and selecting the inputs for assessing the impairment calculation, based

on the Company’s past history, existing market conditions as well as future estimates at the end of each balance sheet date.

Financial assets are written off when there is no reasonable expectation of recovery, however, the Company continues to attempt to

recover the receivables. Where recoveries are made, these are recognised in the Statement of Profit and Loss.

(i) Trade receivables

Trade receivables are non-interest bearing; Refer Note No. 36(11) for credit terms.

Trade receivables includes H Nil (Previous Year: H 15878.23 Lacs) backed by letter of credit as referred in Note No. 7(ii) discounted /

negotiated with banks on recourse basis and thereby the credit risk was retained by the Company and receivables were not de-

recognized in the financial statements.

An impairment analysis is performed at each balance sheet date on an individual basis for major customers. In addition, a large

number of minor receivables are grouped into homogenous groups and assessed for impairment collectively. The maximum

exposure to credit risk at the balance sheet date is the carrying value of each class of financial assets disclosed under Note No. 7.

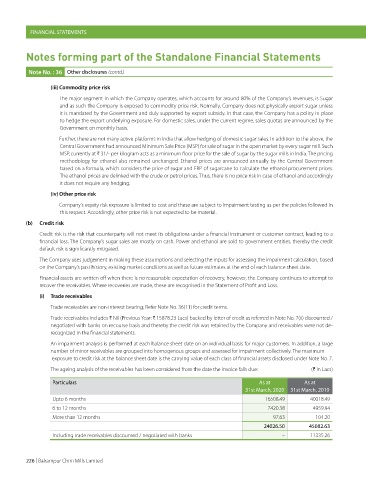

The ageing analysis of the receivables has been considered from the date the invoice falls due: (H in Lacs)

Particulars As at As at

31st March, 2020 31st March, 2019

Upto 6 months 16508.49 40018.49

6 to 12 months 7420.38 4959.94

More than 12 months 97.63 104.20

24026.50 45082.63

Including trade receivables discounted / negotiated with banks – 11335.26

226 | Balrampur Chini Mills Limited