Page 229 - BCML AR 2019-20

P. 229

BALRAMPUR CHINI MILLS LIMITED

Notes forming part of the Standalone Financial Statements

Note No. : 36 Other disclosures (contd.)

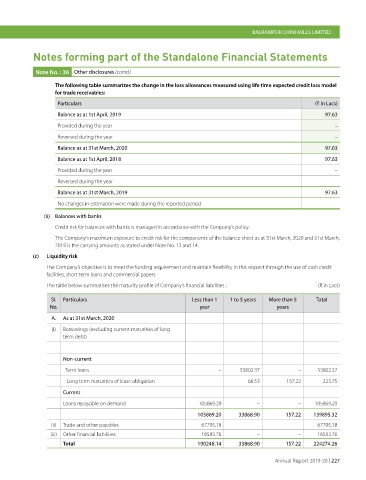

The following table summarizes the change in the loss allowances measured using life time expected credit loss model

for trade receivables:

Particulars (H in Lacs)

Balance as at 1st April, 2019 97.63

Provided during the year –

Reversed during the year –

Balance as at 31st March, 2020 97.63

Balance as at 1st April, 2018 97.63

Provided during the year –

Reversed during the year –

Balance as at 31st March, 2019 97.63

No changes in estimation were made during the reported period.

(ii) Balances with banks

Credit risk for balances with banks is managed in accordance with the Company’s policy.

The Company’s maximum exposure to credit risk for the components of the balance sheet as at 31st March, 2020 and 31st March,

2019 is the carrying amounts as stated under Note No. 13 and 14.

(c) Liquidity risk

The Company’s objective is to meet the funding requirement and maintain flexibility in this respect through the use of cash credit

facilities, short term loans and commercial papers.

The table below summarises the maturity profile of Company’s financial liabilities : (H in Lacs)

Sl. Particulars Less than 1 1 to 5 years More than 5 Total

No. year years

A. As at 31st March, 2020

(i) Borrowings (excluding current maturities of long -

term debt)

Non-current

Term loans – 33802.37 – 33802.37

Long term maturities of lease obligation 66.53 157.22 223.75

Current

Loans repayable on demand 105869.20 – – 105869.20

105869.20 33868.90 157.22 139895.32

(ii) Trade and other payables 67795.18 – – 67795.18

(iii) Other financial liabilities 16583.76 – – 16583.76

Total 190248.14 33868.90 157.22 224274.26

Annual Report 2019-20 | 227