Page 275 - BCML AR 2019-20

P. 275

BALRAMPUR CHINI MILLS LIMITED

Notes forming part of the Consolidated Financial Statements

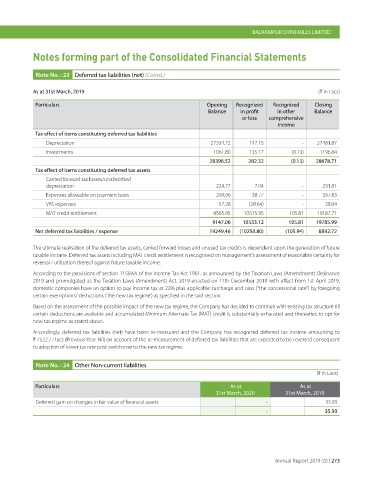

Note No. : 23 Deferred tax liabilities (net) (Contd.)

As at 31st March, 2019 (H in Lacs)

Particulars Opening Recognized Recognized Closing

Balance in profit in other Balance

or loss comprehensive

income

Tax effect of items constituting deferred tax liabilities

Depreciation 27334.72 147.15 - 27481.87

Investments 1061.80 135.17 (0.13) 1196.84

28396.52 282.32 (0.13) 28678.71

Tax effect of items constituting deferred tax assets

Carried forward tax losses/unabsorbed

depreciation 224.77 7.04 - 231.81

Expenses allowable on payment basis 299.06 38.77 - 337.83

VRS expenses 57.28 (28.64) - 28.64

MAT credit entitlement 8565.95 10515.95 105.81 19187.71

9147.06 10533.12 105.81 19785.99

Net deferred tax liabilities / expense 19249.46 (10250.80) (105.94) 8892.72

The ultimate realisation of the deferred tax assets, carried forward losses and unused tax credits is dependent upon the generation of future

taxable income. Deferred tax assets including MAT credit entitlement is recognised on management’s assessment of reasonable certainty for

reversal / utilisation thereof against future taxable income.

According to the provisions of section 115BAA of the Income Tax Act 1961, as announced by the Taxation Laws (Amendment) Ordinance

2019 and promulgated as the Taxation Laws (Amendment) Act, 2019 enacted on 11th December 2019 with effect from 1st April 2019,

domestic companies have an option to pay income tax at 22% plus applicable surcharge and cess (“the concessional rate”) by foregoing

certain exemptions/ deductions (‘the new tax regime’) as specified in the said section.

Based on the assessment of the possible impact of the new tax regime, the Company has decided to continue with existing tax structure till

certain deductions are available and accumulated Minimum Alternate Tax (MAT) credit is substantially exhausted and thereafter, to opt for

new tax regime as stated above.

Accordingly, deferred tax liabilities (net) have been re-measured and the Company has recognized deferred tax income amounting to

H 7522.77 lacs (Previous Year: Nil) on account of the re-measurement of deferred tax liabilities that are expected to be reversed consequent

to adoption of lower tax rate post switchover to the new tax regime.

Note No. : 24 Other Non-current liabilities

(H in Lacs)

Particulars As at As at

31st March, 2020 31st March, 2019

Deferred gain on changes in fair value of financial assets - 35.93

- 35.93

Annual Report 2019-20 | 273