Page 274 - BCML AR 2019-20

P. 274

FINANCIAL STATEMENTS

Notes forming part of the Consolidated Financial Statements

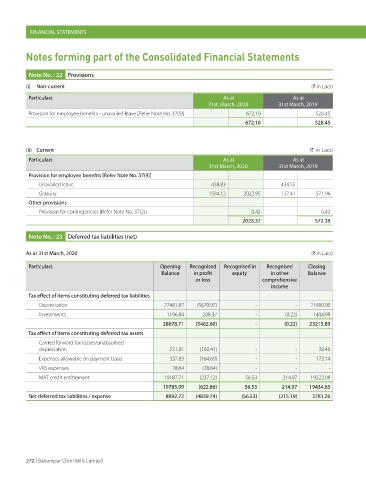

Note No. : 22 Provisions

(i) Non-current (H in Lacs)

Particulars As at As at

31st March, 2020 31st March, 2019

Provision for employee benefits - unavailed leave [Refer Note No. 37(9)] 672.10 528.45

672.10 528.45

(ii) Current (H in Lacs)

Particulars As at As at

31st March, 2020 31st March, 2019

Provision for employee benefits [Refer Note No. 37(9)]

Unavailed leave 438.83 434.55

Gratuity 1584.12 2022.95 137.41 571.96

Other provisions

Provision for contingencies [Refer Note No. 37(2)] 0.42 0.42

2023.37 572.38

Note No. : 23 Deferred tax liabilities (net)

As at 31st March, 2020 (H in Lacs)

Particulars Opening Recognised Recognised in Recognised Closing

Balance in profit equity in other Balance

or loss comprehensive

income

Tax effect of items constituting deferred tax liabilities

Depreciation 27481.87 (5670.97) - - 21810.90

Investments 1196.84 208.37 - (0.22) 1404.99

28678.71 (5462.60) - (0.22) 23215.89

Tax effect of items constituting deferred tax assets

Carried forward tax losses/unabsorbed

depreciation 231.81 (192.41) - - 39.40

Expenses allowable on payment basis 337.83 (164.69) - - 173.14

VRS expenses 28.64 (28.64) - - -

MAT credit entitlement 19187.71 (237.12) 56.53 214.97 19222.09

19785.99 (622.86) 56.53 214.97 19434.63

Net deferred tax liabilities / expense 8892.72 (4839.74) (56.53) (215.19) 3781.26

272 | Balrampur Chini Mills Limited