Page 269 - BCML AR 2019-20

P. 269

BALRAMPUR CHINI MILLS LIMITED

Notes forming part of the Consolidated Financial Statements

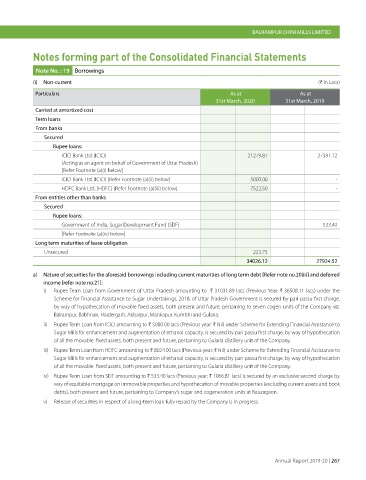

Note No. : 19 Borrowings

(i) Non-current (H in Lacs)

Particulars As at As at

31st March, 2020 31st March, 2019

Carried at amortized cost

Term loans

From banks

Secured

Rupee loans:

ICICI Bank Ltd. (ICICI) 21279.87 27391.12

(Acting as an agent on behalf of Government of Uttar Pradesh)

[Refer Footnote (a)(i) below]

ICICI Bank Ltd. (ICICI) [Refer Footnote (a)(ii) below] 5000.00 -

HDFC Bank Ltd. (HDFC) [Refer Footnote (a)(iii) below] 7522.50 -

From entities other than banks

Secured

Rupee loans:

Government of India, Sugar Development Fund (SDF) - 533.40

[Refer Footnote (a)(iv) below]

Long term maturities of lease obligation

Unsecured 223.75 -

34026.12 27924.52

a) Nature of securities for the aforesaid borrowings including current maturities of long term debt [Refer note no.20(ii)] and deferred

income [refer note no.21]:

i) Rupee Term Loan from Government of Uttar Pradesh amounting to H 31031.89 lacs (Previous Year: H 36508.11 lacs) under the

Scheme for Financial Assistance to Sugar Undertakings, 2018, of Uttar Pradesh Government is secured by pari passu first charge,

by way of hypothecation of movable fixed assets, both present and future, pertaining to seven cogen units of the Company viz.

Balrampur, Babhnan, Haidergarh, Akbarpur, Mankapur, Kumbhi and Gularia.

ii) Rupee Term Loan from ICICI amounting to H 5000.00 lacs (Previous year: H Nil) under Scheme for Extending Financial Assistance to

Sugar Mills for enhancement and augmentation of ethanol capacity, is secured by pari passu first charge, by way of hypothecation

of all the movable fixed assets, both present and future, pertaining to Gularia distillery unit of the Company.

iii) Rupee Term Loan from HDFC amounting to H 8024.00 lacs (Previous year: H Nil) under Scheme for Extending Financial Assistance to

Sugar Mills for enhancement and augmentation of ethanol capacity, is secured by pari passu first charge, by way of hypothecation

of all the movable fixed assets, both present and future, pertaining to Gularia distillery unit of the Company.

iv) Rupee Term Loan from SDF amounting to H 533.40 lacs (Previous year: H 1066.81 lacs) is secured by an exclusive second charge by

way of equitable mortgage on immovable properties and hypothecation of movable properties (excluding current assets and book

debts), both present and future, pertaining to Company’s sugar and cogeneration units at Rauzagaon.

v) Release of securities in respect of a long-term loan fully repaid by the Company is in progress.

Annual Report 2019-20 | 267