Page 266 - BCML AR 2019-20

P. 266

FINANCIAL STATEMENTS

Notes forming part of the Consolidated Financial Statements

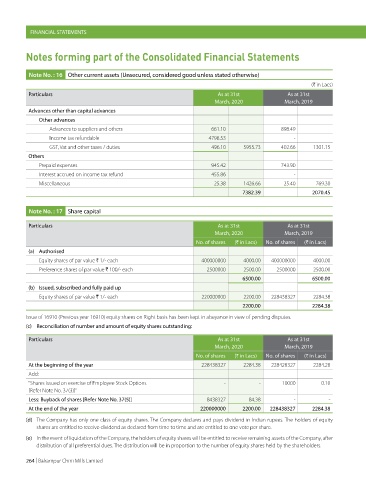

Note No. : 16 Other current assets (Unsecured, considered good unless stated otherwise)

(H in Lacs)

Particulars As at 31st As at 31st

March, 2020 March, 2019

Advances other than capital advances

Other advances

Advances to suppliers and others 661.10 898.49

Income tax refundable 4798.53 -

GST, Vat and other taxes / duties 496.10 5955.73 402.66 1301.15

Others

Prepaid expenses 945.42 743.90

Interest accrued on income tax refund 455.86 -

Miscellaneous 25.38 1426.66 25.40 769.30

7382.39 2070.45

Note No. : 17 Share capital

Particulars As at 31st As at 31st

March, 2020 March, 2019

No. of shares (H in Lacs) No. of shares (H in Lacs)

(a) Authorised

Equity shares of par value H 1/- each 400000000 4000.00 400000000 4000.00

Preference shares of par value H 100/- each 2500000 2500.00 2500000 2500.00

6500.00 6500.00

(b) Issued, subscribed and fully paid up

Equity shares of par value H 1/- each 220000000 2200.00 228438327 2284.38

2200.00 2284.38

Issue of 16910 (Previous year 16910) equity shares on Right basis has been kept in abeyance in view of pending disputes.

(c) Reconciliation of number and amount of equity shares outstanding:

Particulars As at 31st As at 31st

March, 2020 March, 2019

No. of shares (H in Lacs) No. of shares (H in Lacs)

At the beginning of the year 228438327 2284.38 228428327 2284.28

Add:

"Shares issued on exercise of Employee Stock Options - - 10000 0.10

[Refer Note No. 37(3)]"

Less: Buyback of shares [Refer Note No. 37(5)] 8438327 84.38 - -

At the end of the year 220000000 2200.00 228438327 2284.38

(d) The Company has only one class of equity shares. The Company declares and pays dividend in Indian rupees. The holders of equity

shares are entitled to receive dividend as declared from time to time and are entitled to one vote per share.

(e) In the event of liquidation of the Company, the holders of equity shares will be entitled to receive remaining assets of the Company, after

distribution of all preferential dues. The distribution will be in proportion to the number of equity shares held by the shareholders.

264 | Balrampur Chini Mills Limited