Page 263 - BCML AR 2019-20

P. 263

BALRAMPUR CHINI MILLS LIMITED

Notes forming part of the Consolidated Financial Statements

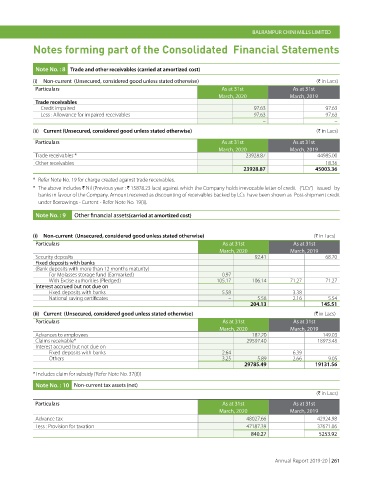

Note No. : 8 Trade and other receivables (carried at amortized cost)

(i) Non-current (Unsecured, considered good unless stated otherwise) (H in Lacs)

Particulars As at 31st As at 31st

March, 2020 March, 2019

Trade receivables

Credit impaired 97.63 97.63

Less : Allowance for impaired receivables 97.63 97.63

– –

(ii) Current (Unsecured, considered good unless stated otherwise) (H in Lacs)

Particulars As at 31st As at 31st

March, 2020 March, 2019

Trade receivables * 23928.87 44985.00

Other receivables – 18.36

23928.87 45003.36

* Refer Note No. 19 for charge created against trade receivables.

* The above includes H Nil (Previous year : H 15878.23 lacs) against which the Company holds irrevocable letter of credit (”LCs”) issued by

banks in favour of the Company. Amount received as discounting of receivables backed by LCs have been shown as Post-shipment credit

under Borrowings - Current - Refer Note No. 19(ii).

Note No. : 9 Other financial assets(carried at amortized cost)

(i) Non-current (Unsecured, considered good unless stated otherwise) (H in Lacs)

Particulars As at 31st As at 31st

March, 2020 March, 2019

Security deposits 92.41 68.70

Fixed deposits with banks

(Bank deposits with more than 12 months maturity)

For Molasses storage fund (Earmarked) 0.97 –

With Excise authorities (Pledged) 105.17 106.14 71.27 71.27

Interest accrued but not due on

Fixed deposits with banks 5.58 3.38

National saving certificates – 5.58 2.16 5.54

204.13 145.51

(ii) Current (Unsecured, considered good unless stated otherwise) (H in Lacs)

Particulars As at 31st As at 31st

March, 2020 March, 2019

Advances to employees 182.20 149.03

Claims receivable* 29597.40 18973.48

Interest accrued but not due on

Fixed deposits with banks 2.64 6.39

Others 3.25 5.89 2.66 9.05

29785.49 19131.56

* Includes claim for subsidy [Refer Note No. 37(8)]

Note No. : 10 Non-current tax assets (net)

(H in Lacs)

Particulars As at 31st As at 31st

March, 2020 March, 2019

Advance tax 48027.66 42924.98

Less : Provision for taxation 47187.39 37671.06

840.27 5253.92

Annual Report 2019-20 | 261