Page 268 - BCML AR 2019-20

P. 268

FINANCIAL STATEMENTS

Notes forming part of the Consolidated Financial Statements

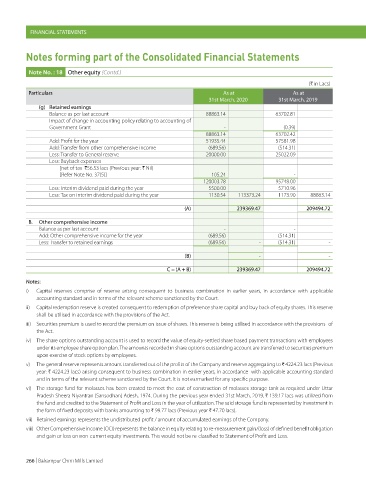

Note No. : 18 Other equity (Contd.)

(H in Lacs)

Particulars As at As at

31st March, 2020 31st March, 2019

(g) Retained earnings

Balance as per last account 88863.14 63702.81

Impact of change in accounting policy relating to accounting of

Government Grant - (0.39)

88863.14 63702.42

Add: Profit for the year 51935.44 57581.98

Add: Transfer from other comprehensive income (689.56) (514.31)

Less: Transfer to General reserve 20000.00 25022.09

Less: Buyback expenses

[net of tax H56.53 lacs (Previous year: H Nil)

[Refer Note No. 37(5)] 105.24 -

120003.78 95748.00

Less: Interim dividend paid during the year 5500.00 5710.96

Less: Tax on interim dividend paid during the year 1130.54 113373.24 1173.90 88863.14

(A) 239369.47 209494.72

B. Other comprehensive income

Balance as per last account - -

Add: Other comprehensive income for the year (689.56) (514.31)

Less: Transfer to retained earnings (689.56) - (514.31) -

(B) - -

C = (A + B) 239369.47 209494.72

Notes:

i) Capital reserves comprise of reserve arising consequent to business combination in earlier years, in accordance with applicable

accounting standard and in terms of the relevant scheme sanctioned by the Court.

ii) Capital redemption reserve is created consequent to redemption of preference share capital and buy back of equity shares. This reserve

shall be utilised in accordance with the provisions of the Act.

iii) Securities premium is used to record the premium on issue of shares. This reserve is being utilised in accordance with the provisions of

the Act.

iv) The share options outstanding account is used to record the value of equity-settled share based payment transactions with employees

under its employee share option plan. The amounts recorded in share options outstanding account are transferred to securities premium

upon exercise of stock options by employees.

v) The general reserve represents amount transferred out of the profits of the Company and reserve aggregating to H 4224.23 lacs (Previous

year: H 4224.23 lacs) arising consequent to business combination in earlier years, in accordance with applicable accounting standard

and in terms of the relevant scheme sanctioned by the Court. It is not earmarked for any specific purpose.

vi) The storage fund for molasses has been created to meet the cost of construction of molasses storage tank as required under Uttar

Pradesh Sheera Niyantran (Sansodhan) Adesh, 1974. During the previous year ended 31st March, 2019, H 139.17 lacs was utilized from

the fund and credited to the Statement of Profit and Loss in the year of utilization. The said storage fund is represented by investment in

the form of fixed deposits with banks amounting to H 99.77 lacs (Previous year H 47.70 lacs).

vii) Retained earnings represents the undistributed profit / amount of accumulated earnings of the Company.

viii) Other Comprehensive income (OCI) represents the balance in equity relating to re-measurement gain/(loss) of defined benefit obligation

and gain or loss on non-current equity investments. This would not be re-classified to Statement of Profit and Loss.

266 | Balrampur Chini Mills Limited