Page 300 - BCML AR 2019-20

P. 300

FINANCIAL STATEMENTS

Notes forming part of the Consolidated Financial Statements

Note No. : 37 Other disclosures (Contd.)

allocable to a segment on reasonable basis have been disclosed as “Unallocable”.

Segment assets and segment liabilities represent assets and liabilities of respective segment. Investments, tax related assets/ liabilities

and other assets and liabilities that cannot be allocated to a segment on reasonable basis have been disclosed as “ Unallocable”.

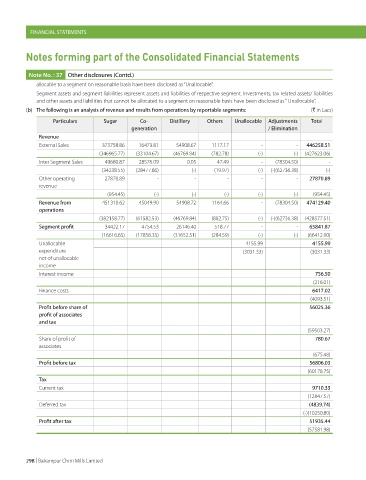

(b) The following is an analysis of revenue and results from operations by reportable segments: (` in Lacs)

Particulars Sugar Co- Distillery Others Unallocable Adjustments Total

generation / Elimination

Revenue

External Sales 373758.86 16473.81 54908.67 1117.17 - - 446258.51

(346965.77) (33104.67) (46769.84) (782.78) (-) (-) (427623.06)

Inter Segment Sales 49680.87 28576.09 0.05 47.49 - (78304.50) -

(34238.55) (28477.86) (-) (19.97) (-) (-)(62736.38) (-)

Other operating 27870.89 - - - - - 27870.89

revenue

(954.45) (-) (-) (-) (-) (-) (954.45)

Revenue from 451310.62 45049.90 54908.72 1164.66 - (78304.50) 474129.40

operations

(382158.77) (61582.53) (46769.84) (802.75) (-) (-)(62736.38) (428577.51)

Segment profit 34422.17 4754.53 26146.40 518.77 - - 65841.87

(16616.65) (17858.35) (31652.51) (284.59) (-) (-) (66412.10)

Unallocable 4155.99 4155.99

expenditure (3031.33) (3031.33)

net of unallocable

income

Interest income 756.50

(216.01)

Finance costs 6417.02

(4093.51)

Profit before share of 56025.36

profit of associates

and tax

(59503.27)

Share of profit of 780.67

associates

(675.48)

Profit before tax 56806.03

(60178.75)

Tax

Current tax 9710.33

(12847.57)

Deferred tax (4839.74)

(-)(10250.80)

Profit after tax 51935.44

(57581.98)

298 | Balrampur Chini Mills Limited