Page 303 - BCML AR 2019-20

P. 303

BALRAMPUR CHINI MILLS LIMITED

Notes forming part of the Consolidated Financial Statements

Note No. : 37 Other disclosures (Contd.)

(e) Geographical information:

Refer Note No. 37(12) (c) above for disclosures relating to revenue disaggregated by geographical market.

(f) Information about major customers:

No single customer contributed 10% or more of the total revenue of the Company for the year ended 31st March, 2020 and 31st March,

2019.

13. The Company has adopted Ind AS 116 ‘Leases’ with effect from 1st April, 2019 and applied the Standard to lease contracts existing on 1st

April, 2019 using the modified retrospective method , and therefore, comparatives for the year ended 31st March, 2019 have not been

restated.

Consequent to this, such assets have been recognised as “Right-of-use” assets and have been amortized over the term of the lease.

Further, finance cost in respect of corresponding lease liabilities has been measured and considered in these consolidated financial

statements.

The Company’s lease asset class primarily consist of leases for land. The Company has entered into various agreements in respect of land

under lease arrangements. The lease agreements include renewal and escalation clause and do not provide the Company a right to sub-

lease. For most of the lease agreements, original lease term is 30 years subject to maximum of 90 years from the date of inception.

The following is the summary of practical expedients elected on initial application:

(i) Applied the practical expedient to the transactions previously identified as leases under Ind AS 17.

(ii) Applied the exemption not to recognize Right-of-use assets and liabilities for leases with less than 12 months of lease term on the

date of initial application

Pursuant to the said transition, the Company has re-classified its leased assets as Right-of-use (“ROU”) assets. Disposals / deductions /

adjustments during the year ended 31st March 2020 as shown under Note No. 4 – Property, plant and equipment include reclassification

with respect to Right-of-use asset with corresponding increase of such assets being shown under Additions / reclassification during the

year.

Depreciation charge for Right-of-use assets is included under depreciation and amortization expense in the Consolidated Statement of

Profit and Loss.

Further, to above, the Company has certain lease arrangement on short term basis, expenditure on which has been recognised under

line item “Rent” under Other expenses.

The effect of adoption of Ind AS 116 ‘Leases’ is not material on the profit before tax, profit for the year and earnings per share.

The details of the contractual maturities of lease liabilities as at 31st March, 2020 on an undiscounted basis have been disclosed under

Note No. 37(20)(c ).

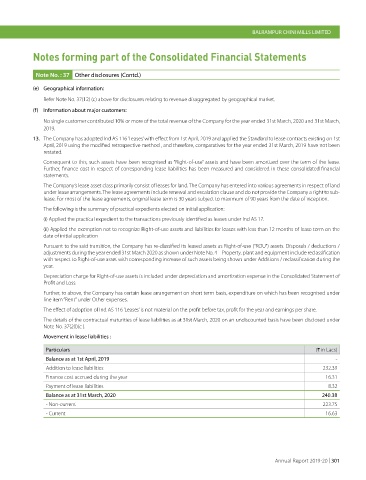

Movement in lease liabilities :

Particulars (H in Lacs)

Balance as at 1st April, 2019 -

Addition to lease liabilities 232.39

Finance cost accrued during the year 16.31

Payment of lease liabilities 8.32

Balance as at 31st March, 2020 240.38

- Non-current 223.75

- Current 16.63

Annual Report 2019-20 | 301