Page 308 - BCML AR 2019-20

P. 308

FINANCIAL STATEMENTS

Notes forming part of the Consolidated Financial Statements

Note No. : 37 Other disclosures (Contd.)

20. Financial risk management objectives and policies

The Company’s principal financial liabilities includes borrowings, trade payables and other financial liabilities and principal financial

assets include trade receivables, cash and cash equivalents, bank balances other than cash and cash equivalents and other financial

assets.

The Company is exposed to credit risk, liquidity risk and market risk. The Company’s senior management under the supervision of Board

of Directors oversees the management of these risks. The policies framed with respect to risks summarised below provides assurance

that the Company’s financial risks are governed by appropriate policies and procedures and that financial risks are identified, measured

and managed in accordance with the Company’s policies and risk objectives.

(a) Market risk

Market risk is the risk that the fair value of future cash flows of a financial instrument will fluctuate because of changes in market

prices. Market risk comprises three types of risk: interest rate risk, currency risk and other risks, such as regulatory risk and commodity

price risk.

(i) Interest rate risk

Interest rate risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in

market interest rates. The Company’s exposure to the risk of changes in market interest rates relates primarily to the Company’s

borrowings obligations.

Sugar is produced over a period of 4 to 5 months and is required to be stored for sale over a period of 12 months, thereby

resulting in very high requirement of working capital. Cost of funding depends on the overall fiscal environment in the country

as well as the Company’s credit worthiness /credit ratings. Failure to maintain credit rating can adversely affect the cost of

funds.

To mitigate the interest rate risk, the Company maintains an impeccable track record and ensures long term relation with

the lenders to raise adequate funds at competitive rates. Company has access to low cost borrowings because of its healthy

Balance Sheet. Moreover, Company deals with five banks thereby reduces risk significantly. In addition, steady revenue from

co-generation and distillery business reduces the overall requirement of working capital.

(ii) Foreign currency risk

Foreign currency risk is the risk that the fair value or future cash flows of an exposure will fluctuate because of changes in foreign

exchange rates. To mitigate foreign exchange risk, the Company covers its position through permitted hedging methods.

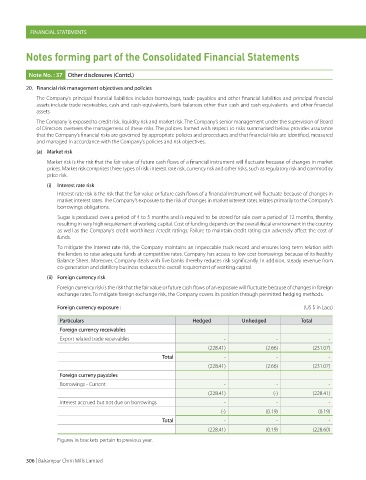

Foreign currency exposure : (US $ in Lacs)

Particulars Hedged Unhedged Total

Foreign currency receivables

Export related trade receivables - - -

(228.41) (2.66) (231.07)

Total - - -

(228.41) (2.66) (231.07)

Foreign curreny payables

Borrowings - Current - - -

(228.41) (-) (228.41)

Interest accrued but not due on borrowings - - -

(-) (0.19) (0.19)

Total - - -

(228.41) (0.19) (228.60)

Figures in brackets pertain to previous year.

306 | Balrampur Chini Mills Limited