Page 311 - BCML AR 2019-20

P. 311

BALRAMPUR CHINI MILLS LIMITED

Notes forming part of the Consolidated Financial Statements

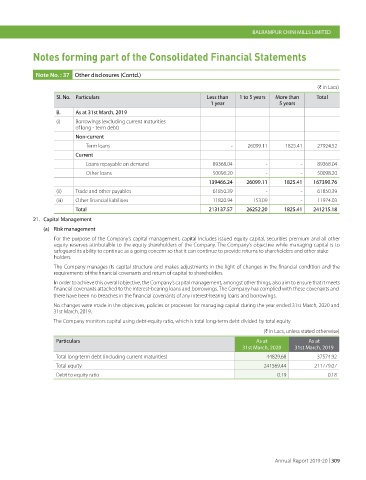

Note No. : 37 Other disclosures (Contd.)

(H in Lacs)

Sl. No. Particulars Less than 1 to 5 years More than Total

1 year 5 years

B. As at 31st March, 2019

(i) Borrowings (excluding current maturities

of long - term debt)

Non-current

Term loans - 26099.11 1825.41 27924.52

Current

Loans repayable on demand 89368.04 - - 89368.04

Other loans 50098.20 - - 50098.20

139466.24 26099.11 1825.41 167390.76

(ii) Trade and other payables 61850.39 - - 61850.39

(iii) Other financial liabilities 11820.94 153.09 - 11974.03

Total 213137.57 26252.20 1825.41 241215.18

21. Capital Management

(a) Risk management

For the purpose of the Company’s capital management, capital includes issued equity capital, securities premium and all other

equity reserves attributable to the equity shareholders of the Company. The Company’s objective while managing capital is to

safeguard its ability to continue as a going concern so that it can continue to provide returns to shareholders and other stake

holders.

The Company manages its capital structure and makes adjustments in the light of changes in the financial condition and the

requirements of the financial covenants and return of capital to shareholders.

In order to achieve this overall objective, the Company’s capital management, amongst other things, also aim to ensure that it meets

financial covenants attached to the interest-bearing loans and borrowings. The Company has complied with these covenants and

there have been no breaches in the financial covenants of any interest-bearing loans and borrowings.

No changes were made in the objectives, policies or processes for managing capital during the year ended 31st March, 2020 and

31st March, 2019.

The Company monitors capital using debt-equity ratio, which is total long-term debt divided by total equity

(H in Lacs, unless stated otherwise)

Particulars As at As at

31st March, 2020 31st March, 2019

Total long-term debt (including current maturities) 44829.68 37574.92

Total equity 241569.44 211779.07

Debt to equity ratio 0.19 0.18

Annual Report 2019-20 | 309