Page 295 - BCML AR 2019-20

P. 295

BALRAMPUR CHINI MILLS LIMITED

Notes forming part of the Consolidated Financial Statements

Note No. : 37 Other disclosures (Contd.)

(ii) Market and liquidity risks:

These are the risks that the investments do not meet the expected returns over the medium to long term. This also encompasses

the mismatch between assets and liabilities. In order to minimise the risks, the structure of the portfolios is reviewed and asset-

liability matching analysis are performed on a regular basis.

(d) Asset - liability management and funding arrangements

The trustees are responsible for determining the investment strategy of plan assets. The overall investment policy and strategy for

Company’s funded defined benefit plan is guided by the objective of achieving an investment return which, together with the

contribution paid is sufficient to maintain reasonable control over various funding risks of the plan.

(e) Other disclosures :

(i) Following are the assumptions used to determine the benefit obligation:

Discount rate:

The yield of government bonds are considered as the discount rate. The tenure has been considered taking into account the

past long term trend of employees’ average remaining service life which reflects the average estimated term of the post -

employment benefit obligations.

Rate of escalation in salary :

The estimates of rate of escalation in salary, considered in actuarial valuation, take into account inflation, seniority, promotion

and other relevant factors including supply and demand in the employment market. The above information is certified by the

actuary. Rate of return on plan assets:

Rate of return for the year was the average yield of the portfolio in which Company’s plan assets are invested over a tenure

equivalent to the entire life of the related obligation.

Attrition rate :

Attrition rate considered is the management’s estimate based on the past long- term trend of employee turnover in the

Company.

(ii) The Gratuity and Provident Fund expenses have been recognised under “ Contribution to provident, gratuity and other funds”

and Leave Encashment under Salaries and Wages under Note No. 31 - Employee benefits expense.

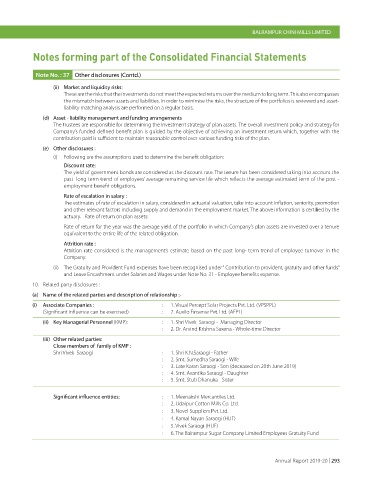

10. Related party disclosures :

(a) Name of the related parties and description of relationship :-

(i) Associate Companies : : 1. Visual Percept Solar Projects Pvt. Ltd. (VPSPPL)

(Significant influence can be exercised) : 2. Auxilo Finserve Pvt. Ltd. (AFPL)

(ii) Key Managerial Personnel (KMP): : 1. Shri Vivek Saraogi - Managing Director

: 2. Dr. Arvind Krishna Saxena - Whole-time Director

(iii) Other related parties:

Close members of family of KMP :

Shri Vivek Saraogi : 1. Shri K.N.Saraogi - Father

: 2. Smt. Sumedha Saraogi - Wife

: 3. Late Karan Saraogi - Son (deceased on 20th June 2019)

: 4. Smt. Avantika Saraogi - Daughter

: 5. Smt. Stuti Dhanuka - Sister

Significant influence entities: : 1. Meenakshi Mercantiles Ltd.

: 2. Udaipur Cotton Mills Co. Ltd.

: 3. Novel Suppliers Pvt. Ltd.

: 4. Kamal Nayan Saraogi (HUF)

: 5. Vivek Saraogi (HUF)

: 6. The Balrampur Sugar Company Limited Employees Gratuity Fund

Annual Report 2019-20 | 293